A tax invoice is a written or electronic document that documents the occurrence and specifics of a taxable supply and is defined as such by the UAE VAT Law. Article 65 of the VAT Law requires the tax registrants making taxable supplies to issue an original Tax Invoice Format in the UAE and send it to the recipients of the goods and services. In cases where the provisions exceed AED 10,000, all tax registrants must produce tax invoices on taxable deliveries to other registrants with all mandatory details.

Businesses that don’t send out tax invoices are subject to administrative fines. The UAE VAT Law has established several requirements for issuing tax invoices. Businesses in the UAE must strictly adhere to these requirements to avoid administrative VAT penalties.

Requirements for Tax Invoice Format UAE

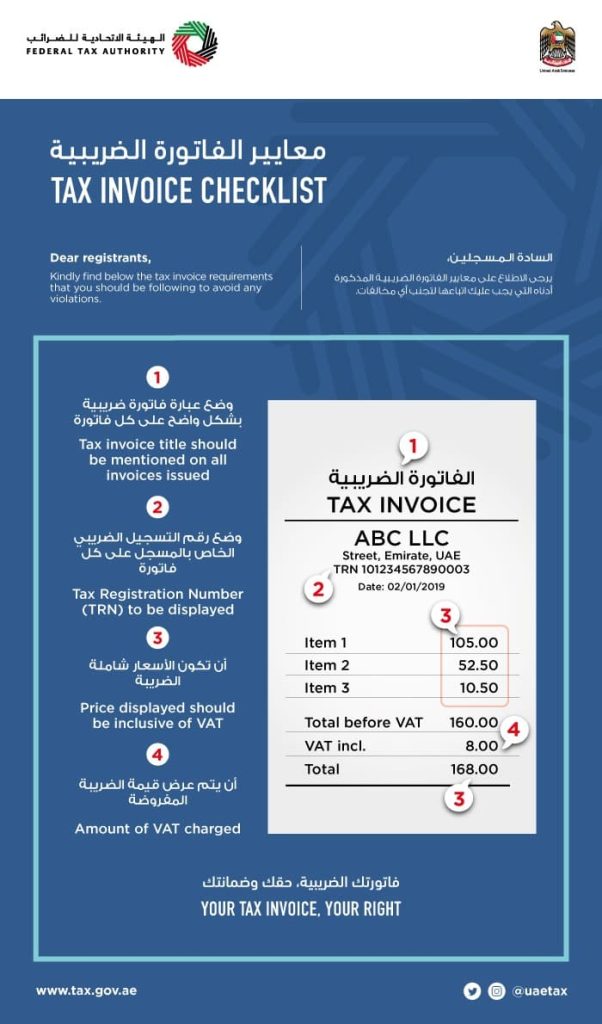

Understanding the Tax Invoice Format in UAE is essential for businesses. To comply with the requirements, a UAE tax invoice must include the following details:

- Title: The words “Tax Invoice” must be displayed.

- Invoice Number: A unique sequential number for each invoice.

- Date of Issuance: The date the invoice was issued.

- Seller Information:

- Name

- Address

- Tax Registration Number (TRN)

- Buyer Information:

- Name

- Address

- TRN (if applicable)

- Description of Goods/Services: Detailed description of the goods or services provided.

- Quantity and Unit Price: Breakdown of the quantity and unit price of the supplies.

- Tax Details:

- Applicable Tax rate

- The exact amount of Tax charged

Meeting these requirements ensures that your tax invoices are clear, comprehensive, and legally compliant, facilitating accurate VAT calculation and reporting. This helps protect businesses from potential penalties and legal issues in the UAE.

UAE Requirements for Issuing Tax Invoices

To issue a tax invoice in the UAE, businesses must meet certain requirements according to Article 59 of the Executive Regulations. Here are the key points:

Tax Invoice Requirement:

- Companies must provide a tax invoice whenever a supply is made.

- The recipient of the supply must receive the tax invoice.

Simplified Tax Invoice:

- Only eligible suppliers can issue a simplified tax invoice.

- A simplified tax invoice does not require a net value (amount excluding tax).

Full Tax Invoice:

- Each line item’s tax value and net value must be displayed.

- Gross value is not required.

Mandatory Details:

- Name, address, and Tax Registration Number (TRN) of the supplier and the recipient.

- Date of issuance.

- Unique invoice number.

- Description of the goods or services supplied.

VAT Amount:

- Indicate the amount of VAT being charged.

- This should be separate from the total amount being charged.

Zero-Rated or Exempt Supplies:

- Clearly state that no VAT is charged for zero-rated or exempt supplies.

Record Keeping:

- Keep a record of all VAT invoices issued and received.

- Helps in staying on top of VAT reporting requirements.

Compliance:

- Ensure the VAT invoice format complies with UAE VAT regulations.

- The format should include all mandatory information and be easy to understand.

Proper Signing and Dating:

- Ensure VAT invoices are properly signed and dated to avoid disputes.

Following these guidelines ensures your tax invoices comply with UAE regulations and helps avoid potential issues.

UAE’s Issuance of a Simplified Tax Invoice for VAT

The Federal Tax Authority permits the tax invoice’s contents to contain less information than is customary in certain circumstances. In the United Arab Emirates, these invoices are simplified tax invoices, which are permitted by Article 59(5) of the Executive Regulations. It is possible to issue a simplified tax invoice in the following situations:

- If the recipient of the goods does not have a UAE VAT registration.

- If the recipient is a VAT-registered party and the supply’s consideration is AED 10,000 or less.

VAT Invoice Format UAE

VAT invoice Format in UAE is an important activity for all organisations registered for VAT. When a taxable supply of goods or services is made, a registrant must issue a tax invoice, a crucial document.

All firms must adhere to the VAT invoice format established by the FTA to avoid VAT fines and penalties in the UAE. For all organisations, knowing how to create a tax invoice in the UAE is a crucial duty and question.

UAE FTA Tax Invoice Format

Maintaining the correct VAT invoice format in the UAE is important for complying with the UAE VAT regulations. The Federal Tax Authority (FTA) has specific requirements for VAT invoices that businesses must follow. These requirements help ensure accurate reporting and payment of VAT.

Why Proper VAT Invoice Format is Important

- Compliance: Avoid penalties and fines from the FTA for non-compliance.

- Accurate Record-Keeping: Helps businesses track VAT transactions and calculate VAT liabilities accurately.

Types of Tax Invoices

- Simplified Tax Invoice

- Full Tax Invoice

By following the FTA’s requirements, businesses can stay compliant and manage their VAT transactions effectively.

Simplified Tax Invoice

Line items will be displayed at the gross value in a streamlined tax invoice.

The following information must be included in a simplified tax invoice format UAE:

- The invoice plainly states that it is a “Tax Invoice”.

- The supplier’s name, address, and Tax Registration Number (TRN).

- The day the tax invoice was sent out.

- A summary of the products or services offered.

- The total consideration was received, and the taxes were paid.

The whole consideration (or total gross value) is displayed at the bottom of the simplified tax invoice, and the tax included in that value is shown on a separate line.

Full Tax Invoice

Businesses are typically required to provide a complete tax invoice. The following information should be included in a comprehensive tax invoice format UAE:

- A clear depiction of the text Tax Invoice.

- The supplier’s name, address, and tax identification number.

- The recipient’s name, address, and tax identification number.

- Tax invoice number in order.

- When the invoice was first issued.

- Supply date.

- A summary of the products or services.

- Total amount due in AED.

- Each line must contain net value and tax amount

Tax Invoices Issued in Foreign Currencies

When issuing a tax invoice in a foreign currency, the following details are required:

- Tax Amount: The tax amount payable must be expressed in AED.

- Exchange Rate: The exchange rate applied, as per the rates published by the UAE Central Bank on the date of supply, must be included.

Tax Invoice Rounding

When a tax invoice must be made, and the tax owed on the supply is expressed as a fraction of a Fils, the amount may be rounded mathematically to the closest Fils.

As previously stated, the tax amount should be calculated line by line. In practice, any rounding should also be done line by line.

Mathematical logic should be used to round the tax value on the tax invoice to the closest whole Fils or two decimal places. This is meant by “rounding the value on a mathematical basis.”

For instance: 9.862 AED would change to 9.86, while 2.357 AED would become 2.36.

VAT for Discounted Bills

VAT will be applied to the value that is calculated after taking the discount into account. After the discount, VAT will be added to the pricing.

Only if the following requirements, which are outlined in UAE VAT Executive regulations, are satisfied will the discount be permitted to be deducted from the value of supply:

- The price drop has been advantageous to the buyer.

- The discount was funded by the supplier.

For example, if the supply value is 10,000 AED and the discount is 500 AED. In this instance, after considering the discount value, the value of the supply is determined to be AED 9,500. VAT will be applied to AED 9,500.

Tax Invoice-Related Administrative Penalties format

The UAE Tax Procedures Law makes it illegal to disregard tax invoice standards. According to the amended VAT penalties regime, firms that fail to produce a tax invoice when making any supply will receive an AED 2,500 fine for each case.

Businesses that issue tax invoices electronically, if they do not follow the rules and regulations for the UAE’s issue of electronic tax invoices, will be subject to a fine of AED 2,500. Dubai’s VAT advisors can help companies avoid fines.

FTA Approved Tax Agents in the UAE

Businesses that fail to send tax invoices will be subject to severe fines, but VAT consultants in Dubai, like Shuraa Tax Consultants, can help you avoid the penalty. One of the top FTA-approved tax agents in the UAE, our knowledgeable staff can assist you with requirements such as UAE VAT registration, VAT deregistration, VAT compliance / VAT Return, excise tax services, and services linked to VAT reconsideration, Corporate Tax filing, etc. Get in touch today at +971508912062. You can also email us at info@shuraatax.com.