Value Added Tax (VAT) has become an integral part of the UAE’s tax system since its introduction in 2018. It affects both businesses and individuals, so it’s important for everyone to understand how it works. Two important parts of VAT are reimbursement and disbursement—these processes help people manage their tax payments and stay compliant with the law.

In simple terms, VAT reimbursement allows businesses and eligible individuals to recover VAT paid on expenses related to their operations, while VAT disbursement involves recovering exact amounts paid on behalf of clients without additional VAT charges.

If you’re a business owner looking for a tax refund or an individual eligible for VAT reimbursement on expenses in the UAE, knowing these processes is essential. A Shuraa tax, we will assist you through everything you need to know about VAT reimbursement and disbursement in the UAE, so you can handle them easily and stay on the right side of the rules.

VAT Reimbursement in the UAE

VAT reimbursement in the UAE is a process whereby businesses and individuals can claim a refund of the Value-Added Tax (VAT) they have paid. This is typically applicable when the VAT paid is not recoverable as input tax against taxable supplies or when a surplus of input tax exists.

Eligibility Criteria for VAT Reimbursement

Several types of entities may be eligible to claim VAT reimbursement in the UAE:

Businesses

Companies registered for VAT in the UAE have paid VAT on business-related expenses, such as office supplies, rent, and professional services.

Tourists

Non-UAE residents who have purchased goods from VAT-registered retailers wish to claim VAT refunds when exiting the country.

Learn more about how you can claim VAT refund in Dubai as a tourist: VAT Refund in Dubai for Tourists

Government Entities and Diplomatic Missions

Some government bodies and diplomatic missions may be eligible for VAT refunds on purchases made in the UAE.

Foreign Businesses

Under certain conditions, foreign companies with no business presence in the UAE can also reclaim VAT incurred on expenses during their operations in the UAE.

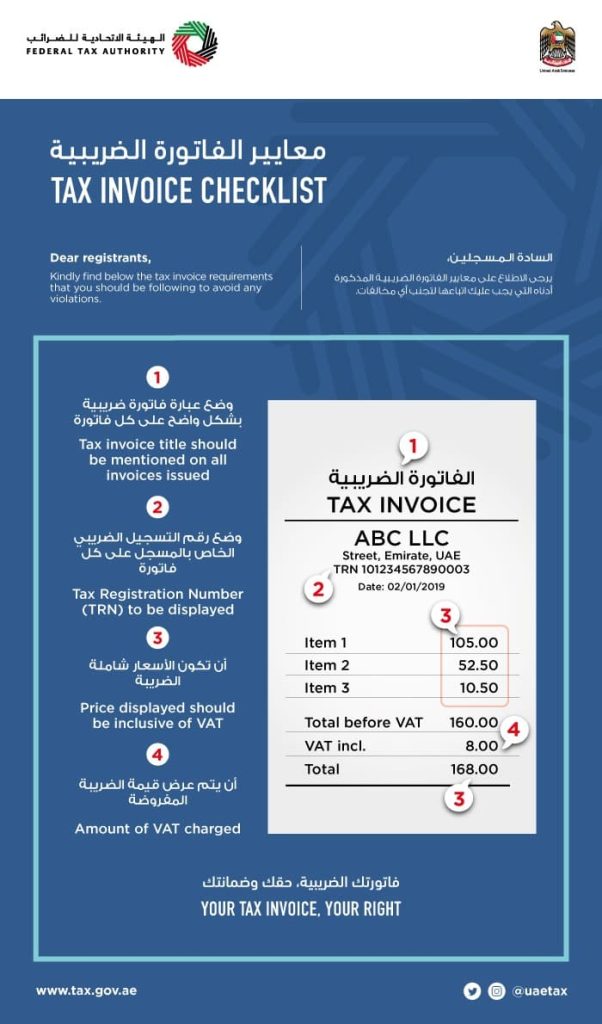

Generally, to be eligible for a VAT refund:

- The VAT must have been paid on eligible business expenses.

- The entity must be registered for VAT with the FTA and have an active VAT number.

The claim should be submitted within the set time frame and accompanied by proper documentation, such as receipts and invoices.

Common Scenarios Leading to VAT Reimbursement Claims

VAT reimbursement claims are typically made in several scenarios, including:

1. Business Purchases

Companies reclaim VAT on eligible expenses like office rent, utilities, equipment purchases, marketing services, and other operational costs.

2. Tourist Refunds

Tourists shopping in the UAE can claim back VAT on goods purchased from registered retailers when they leave the country through designated refund points.

3. Conferences and Events

Businesses participating in exhibitions, conferences, or business events in the UAE can claim VAT paid on entry fees and related services.

4. Cross-border Trade

Companies involved in importing and exporting goods may be eligible for VAT refunds on cross-border transactions if they meet the FTA’s conditions.

5. Excess VAT Paid

If a business has paid more VAT than it is entitled to collect, it can claim a refund for the excess amount

The VAT Reimbursement Process in the UAE

The VAT reimbursement process in the UAE involves several key steps:

1. Register on the FTA Portal

Ensure that your business is registered with the FTA and has an active account [https://tax.gov.ae/en/taxes/Vat/refunds.aspx]. Tourists can apply for VAT refunds through designated refund points at airports and other exit points.

2. Collect and Prepare Documentation

Businesses need to gather and prepare the necessary documentation to support their reimbursement claim. This typically includes:

- Tax registration certificate

- VAT returns

- Invoices for purchases and sales

- Bank statements

- Any other relevant supporting documents

3. Submit the Claim

Log in to the FTA’s online portal, complete the VAT refund application form, and upload the required documents.

4. Review and Approval

The FTA reviews the submitted claim and may request additional information if needed. Once approved, the FTA processes the refund.

5. Receive the Refund

If the claim is approved, the VAT amount will be reimbursed through the specified payment method, such as a bank transfer or other available options.

VAT Disbursement in the UAE

VAT disbursement in the UAE refers to the recovery of an expense that a business has paid on behalf of a client. When a business incurs a cost directly related to providing a service or product to a client and later recovers that exact amount without any markup, this transaction is classified as a disbursement.

When it comes to VAT on reimbursement of expenses in UAE, it’s essential to distinguish it from disbursement. Reimbursement occurs when a business incurs an expense related to a service or product it provides, and then charges the client for that cost. Unlike disbursements, reimbursements are generally considered taxable supplies under the UAE VAT regime. This means that VAT may apply when a business recovers these costs from its client.

Key Features of VAT Disbursement:

- Exact Recovery: The amount recovered from the client is exactly the same as the amount paid, with no additional charges.

- No VAT Implications: Since disbursements are not treated as taxable supplies, they do not attract VAT when the client repays the business.

To qualify as a disbursement under UAE VAT law, a recovery of expense must meet the following conditions:

- The expense must be incurred directly for the benefit of a client.

- The amount recovered by the client must be the exact same amount that was paid by the business, with no additional markup or profit included.

- The reimbursement must not involve the supply of any goods or services. If there is a supply element, the reimbursement may be subject to VAT.

- The business should not recover input tax (VAT) associated with the expense paid on behalf of the client, as disbursements do not qualify for input tax recovery.

Example of VAT Disbursement in the UAE

A marketing agency, XYZ Marketing, has arranged a photoshoot for its client, ABC Enterprises. The agency hires a professional photographer and pays AED 1,050 for the service. This amount includes AED 50 VAT (5% of AED 1,000, the base cost of the service). The agency incurs this expense directly on behalf of ABC Enterprises.

- Total Amount Paid by XYZ Marketing: AED 1,050 (including AED 50 VAT).

- Base Cost of the Photoshoot Service: AED 1,000.

- VAT Paid: AED 50.

When XYZ Marketing requests reimbursement from ABC Enterprises:

- XYZ Marketing charges ABC Enterprises exactly AED 1,050, the same amount it paid the photographer.

- This transaction is considered a disbursement, not a supply, so no additional VAT is added by XYZ Marketing when billing ABC Enterprises.

- ABC Enterprises pays XYZ Marketing AED 1,050, covering the expense exactly as incurred.

Difference Between VAT Disbursement and VAT Reimbursement

While both terms involve recovering costs, there are distinct differences between VAT disbursement and VAT reimbursement:

1. Nature of the Transaction

- VAT Disbursement: It involves the recovery of expenses incurred on behalf of a client without any markup. The payment is treated as a pass-through and not as a supply, so no VAT is charged on the recovery.

- VAT Reimbursement: This refers to claiming back VAT that a business has paid on its own expenses. When businesses incur costs that include VAT, they can file a claim with the Federal Tax Authority (FTA) to recover the VAT portion if the expenses are eligible.

2. VAT Treatment

- VAT Disbursement: The disbursed amount is not subject to VAT because it is not considered a supply. For example, if a business pays AED 500 (including VAT) on behalf of a client and recovers that amount, it does not charge any additional VAT.

- VAT Reimbursement: Involves a business recovering VAT from the FTA on its business-related expenses. This means if a business pays AED 1,000 for supplies and VAT is included, it can claim back the VAT amount from the FTA if the supplies are eligible.

3. Examples

- VAT Disbursement Example: A company pays AED 1,050 (including AED 50 VAT) for a service on behalf of a client and recovers exactly AED 1,050 from the client.

- VAT Reimbursement Example: A company incurs AED 1,000 in expenses for office supplies that include AED 50 VAT. The company can file a claim to recover the AED 50 VAT from the FTA.

How Shuraa Tax Can Help with VAT Reimbursement and Disbursement

Understanding VAT reimbursement and disbursement in UAE is really important for businesses and individuals who want to manage their expenses effectively. Knowing how these processes work can help you recover costs and stay compliant with VAT rules, which are essential for maintaining good cash flow.

If you ever feel overwhelmed by VAT regulations or have questions, it’s a great idea to seek professional help. At Shuraa Tax, we’re here to guide you through all things VAT, including how to handle reimbursement and disbursement. Our experienced team has the experience to help you navigate these processes and make sure you’re meeting all requirements while maximizing your potential refunds.

Contact us today at +971508912062 or email us at info@shuraatax.com to find out how we can help you.

Frequently Asked Questions

1. What is VAT on reimbursement of expenses in the UAE?

VAT on reimbursement of expenses in the UAE applies when a business incurs costs related to a service or product it provides and then charges the client for these costs. In the UAE, such reimbursements are generally considered taxable supplies.

2. Can tourists claim VAT reimbursement in the UAE?

Yes, tourists can claim VAT reimbursement in the UAE. The UAE has a Tourist Refund Scheme that allows eligible tourists to get a refund on the VAT they have paid on goods purchased during their stay.

3. What is the difference between VAT reimbursement and VAT disbursement?

VAT reimbursement involves claiming back VAT that a business has paid on its expenses if those expenses are eligible under VAT rules. VAT disbursement, on the other hand, refers to the recovery of an exact amount that a business has paid on behalf of a client without charging any additional VAT, as it is not treated as a taxable supply.

4. Are all expenses eligible for VAT reimbursement in the UAE?

Not all expenses are eligible for VAT reimbursement in the UAE. Only business-related expenses that meet the FTA’s criteria, such as costs incurred for taxable supplies, can be claimed.

5. How much VAT is refunded in the UAE?

You can typically claim a VAT refund of 85% of the total VAT amount paid in the UAE, after deducting a fee of AED 4.80 per tax-free tag. This refund is available to tourists and visitors who meet certain criteria, such as being non-residents, purchasing eligible goods, and exporting them out of the UAE within a specified timeframe.