Do you know the difference between VAT and TRN? And you look further to register yourself as a taxpayer? Don’t worry; Shuraa Tax has your back. Like you, many entrepreneurs in Dubai and investors have no clue about getting a Tax Registration Number or TRN in Dubai. If you are running a foreign-owned business, you must understand the importance of value-added tax, VAT, and TRN.

In Dubai, the VAT Registration process is essential for every business. This means getting a TRN number. It’s a 15-digit code that shows you’re registered and helps tax authorities keep track of your finances through your invoices.

What’s TRN?

TRN is for Tax Registration Number. The UAE’s federal tax authority uses a 15-digit code, FTA, in short form. Each business gets one TRN number, even if it has different parts or branches.

Remember, if you have a TRN number, you must include all your invoices, documents, and financial activities, such as VAT Returns Filing, Tax Invoices, Tax Credit notes, etc. Only businesses with a TRN certificate can add VAT charges for their customers.

Who Can Get a TRN in the UAE?

If the business operates in the UAE, it must follow the country’s rules and laws. They need to follow the VAT regulations too. To be eligible for VAT registration and a Tax Registration Number (TRN) in the UAE, businesses must meet specific revenue criteria outlined below:

1. For Voluntary Registration

For voluntary registration, you need to follow the points mentioned below:

- You can choose whether to register for VAT if your earnings are between 187,000 AED and 375,000 AED.

- If your business makes over 187,500 AED, you can sign up for VAT and get a TRN.

- If you earn less than 187,500 AED, you don’t have to bother with VAT registration.

2. For Mandatory Registration

For Mandatory Registration, you need to follow the points mentioned below:

- You must get a TRN if your business earns about 375,000 AED.

- If you expect to earn this much in the next month or have earned it in the past year, you must register for VAT to avoid fines.

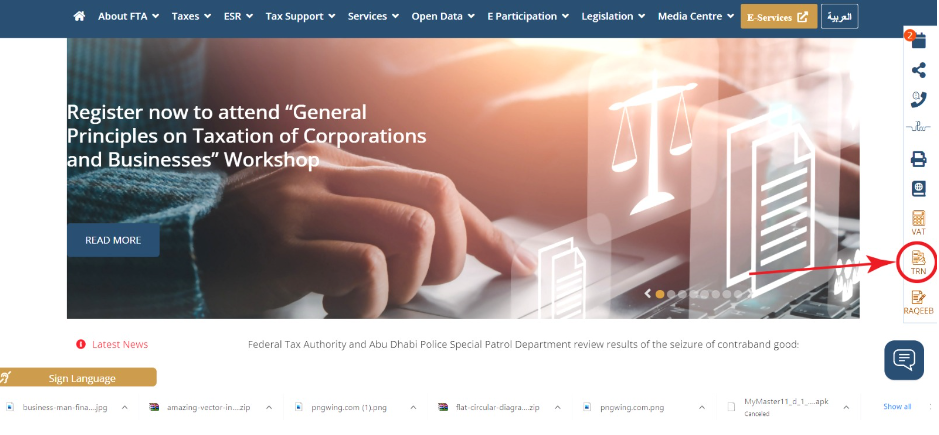

How can the validity of TRN in the UAE be checked?

To verify your TRN in the UAE:

- Go to the FTA website

- Log in to the e-service portal

- Click on “TRN Verification” at the top

- Enter your TRN and click “validate” to check its validity

Documents Needed for TRN Application

To get a TRN for your business in the UAE, you’ll need to submit specific documents to the relevant department. A trusted tax consultancy specialist like Shuraa Tax can help in this process, making sure your timely registration is done. Here’s a list of required documents:

- Company’s Memorandum of Association (MoA)

- The company’s trade license

- Import or export declarations

- Company bank account details

- Company’s turnover declaration letter

- Company’s contact details and address

- Emirates IDs of the shareholder/manager

- Passport copies of the shareholder/manager

- Last year’s income statement and bank details

- Sample invoices from suppliers and customers

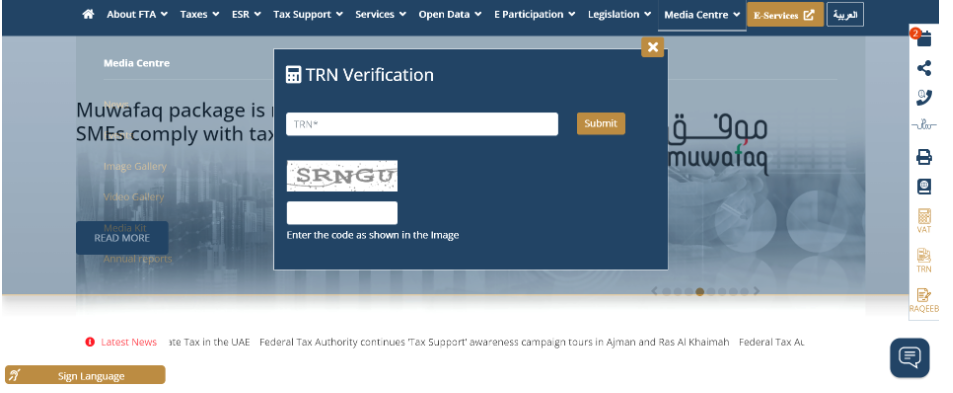

Verifying Your TRN Number

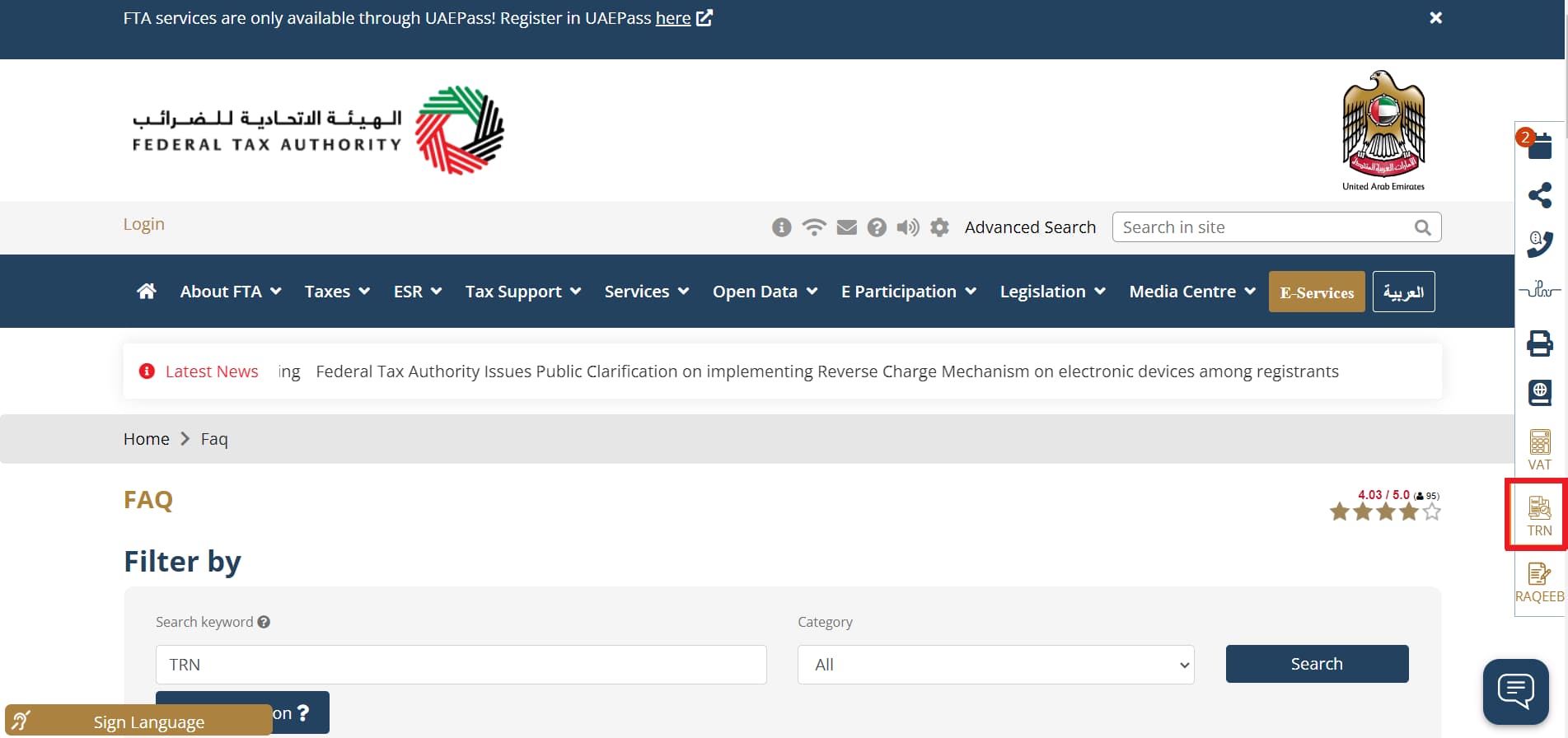

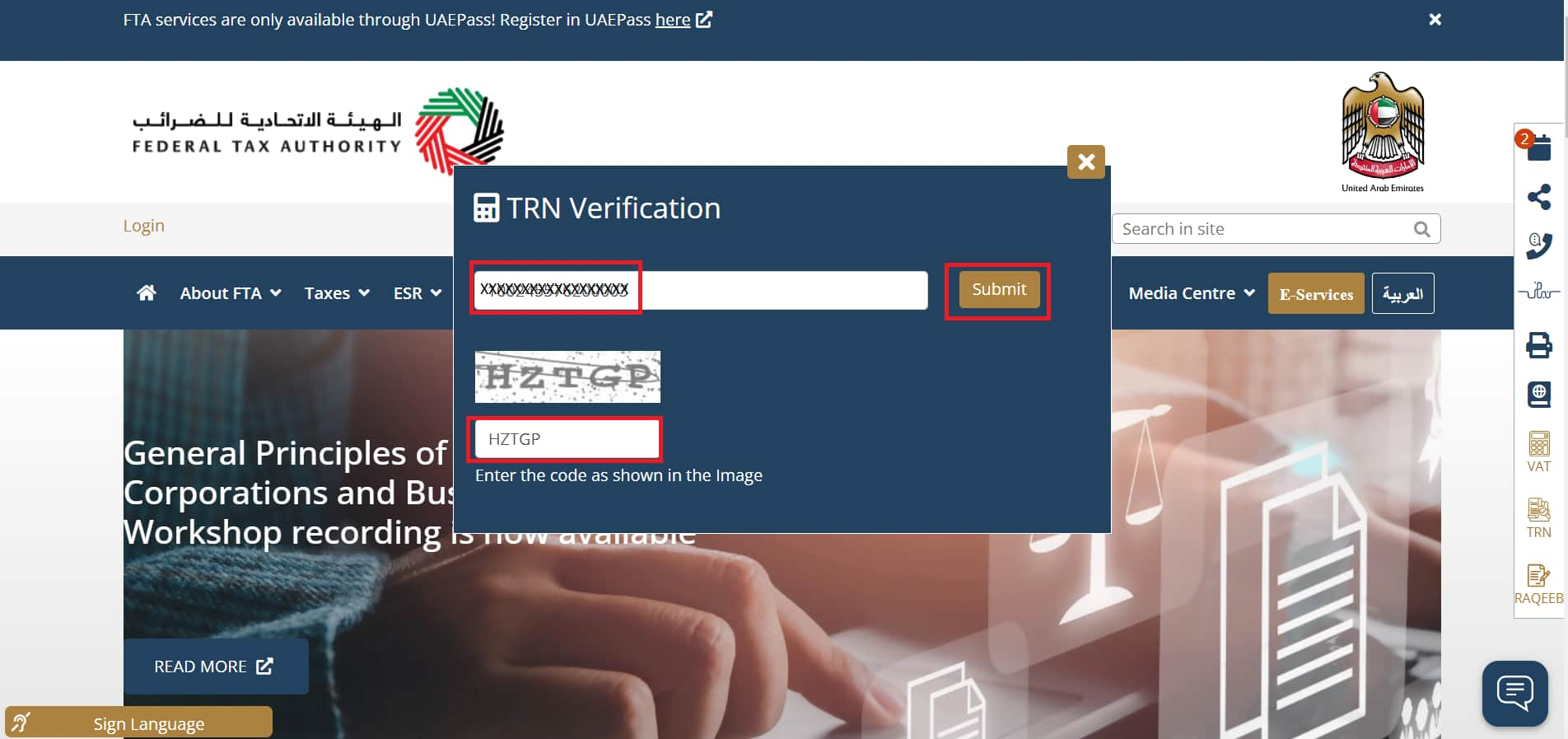

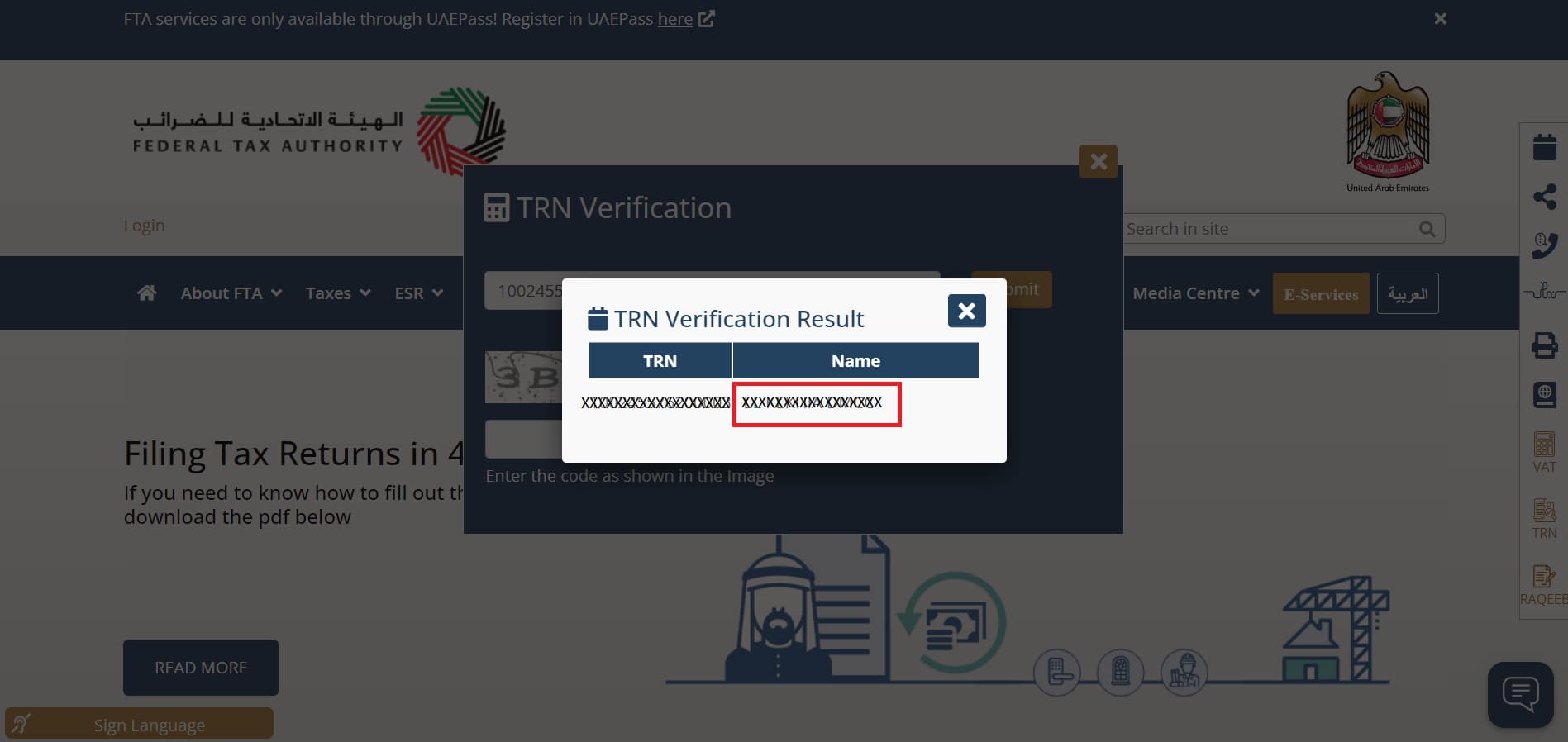

Businesses and individuals in the UAE can now register and validate their TRN numbers through the Federal Tax Authority’s online platform. Alternatively, professional tax consultants like Shuraa Tax can assist with TRN number verification. To verify your TRN number in the UAE, follow these steps:

- Visit the FTA’s EmaraTax portal.

- Find and click on the “TRN Verification” option in the menu on the right side of the page.

- Enter your TRN number in the designated space.

- Type the code displayed in the image.

- Click “submit” to view your TRN verification status.

How to Get VAT Tax Registration Number in Dubai, UAE

Applying for a Tax Registration Number (TRN) in the UAE is mandatory for businesses exceeding the VAT threshold or planning to conduct taxable activities. The process involves registering with the Federal Tax Authority (FTA) through the EmaraTax portal. Below is a comprehensive guide to help you easily navigate the TRN registration Dubai process.

Steps to Apply for a TRN Tax Registration Number in the UAE

Step 1: Create an EmaraTax Account

- Visit the FTA website: Go to https://tax.gov.ae.

- To sign up for EmaraTax, click on the “Sign Up” button and provide your email address, mobile number, and other personal/business details.

- Activate your account: A confirmation email will be sent to your registered email address. Click the activation link to proceed.

This account is essential for managing all your tax-related services, including applying for your TRN Number UAE.

Step 2: Log in and Access the Dashboard

- Log in to your EmaraTax account using your credentials.

- Once inside, you will be directed to the EmaraTax dashboard, where all your tax activities are managed.

Step 3: Create a Taxable Person Profile

- Click on “Create Taxable Person”.

- Fill in all the required details:

- Legal entity name and trade name

- Trade license information

- Business activity type (commercial, professional, industrial, etc.)

- Contact information

- Authorised signatory details

- This profile will be used to apply for your TRN Tax Registration Number.

Step 4: Access the Taxable Person Account

- Once your profile is created, return to the dashboard.

- Click “View” beside your taxable person profile to manage the account or proceed with TRN registration in Dubai.

Step 5: Initiate VAT Registration

- Navigate to “Value Added Tax” in the menu.

- Select “Register” to begin your VAT application process.

Step 6: Fill Out the VAT Registration Form

Provide the following information in the online form:

- Business turnover for the last 12 months (must meet or exceed AED 375,000 for mandatory registration)

- Expected future turnover

- Import/export activity

- GCC business operations

- Bank account details

- Customs registration (if applicable)

Step 7: Upload Required Documents

Prepare and upload scanned copies of the following:

- Valid Trade License

- Memorandum of Association (MoA) or other legal formation documents

- Passport and Emirates ID copies of the owner/partners

- Proof of bank account (IBAN letter or bank statement)

- Sample invoices issued/received

- Income statements and financial records for past 12 months (if applicable)

Step 8: Review & Submit the Application

- Double-check all entered details and uploaded documents.

- Click “Submit” once you’ve confirmed everything is accurate and complete.

Step 9: Application Review by the FTA

- The FTA will review your VAT application.

- You may be asked to provide additional documents or clarifications.

- Upon approval, you will receive your VAT Registration Certificate, which includes your TRN number UAE.

Final Notes on TRN Registration in Dubai

- The TRN (Tax Registration Number) is a 15-digit number issued by the FTA to registered businesses for VAT purposes.

- Display your TRN Tax Registration Number on all tax invoices, credit notes, and VAT returns.

- Businesses must ensure timely registration to avoid fines and penalties.

What Happens After VAT Registration in the UAE?

Once you’ve successfully applied for VAT and submitted your documents through the EmaraTax platform, the Federal Tax Authority (FTA) initiates the review process. Here’s a step-by-step breakdown of what to expect after applying for your TRN registration Dubai.

1. FTA Review and Approval

- The FTA thoroughly examines your application, including all uploaded documents and declared business information.

- If your submission meets all requirements, the FTA will issue your Tax Registration Number (TRN)—a unique 15-digit identifier for VAT purposes in the UAE.

2. Issuance of the VAT Certificate

- You’ll receive an official notification via email once your application is approved.

- Log in to your EmaraTax account to download your VAT Certificate, which includes your:

- TRN number UAE

- Effective VAT registration date

- Legal business name and license details

This certificate is proof of successful TRN tax registration number issuance and must be displayed or submitted during any VAT-related process.

3. Understanding Your Tax Obligations

After receiving your Tax Registration Number UAE, your business is legally obligated to:

- Display the TRN on:

- All tax invoices and credit notes

- VAT returns

- Business correspondences, where applicable

- Maintain accurate financial records, including sales, expenses, and input/output VAT.

- File VAT returns quarterly or monthly (depending on your assigned tax period) via the EmaraTax portal.

- Pay any VAT liabilities by the due date to avoid penalties.

4. FTA Follow-ups and Communication

- The FTA may reach out through your EmaraTax account or email if they require:

- Clarification of submitted information

- Additional supporting documents

- Promptly respond to any communication to prevent delays in processing or possible rejection of your TRN application.

Common Mistakes to Avoid During TRN Registration in Dubai

Even though TRN registration Dubai is a digital process, minor errors can cause significant delays or even lead to rejections. Avoid the following common pitfalls:

1. Submitting Incomplete Applications

All mandatory fields must be completed. Double-check your application before submission to ensure no blanks or missing details.

2. Uploading Incorrect or Unsupported Document Formats

The FTA accepts formats like PDF, JPG, or PNG; files must be under 2 MB. Incorrect formats or oversized files will be rejected automatically.

3. Ignoring Eligibility Criteria

Before applying, make sure your business meets the mandatory (AED 375,000 turnover) or voluntary (AED 187,500) registration thresholds.

4. Providing Inaccurate or Mismatched Information

Ensure accuracy in your:

- Trade license number

- Bank account and IBAN

- Financial turnover

- Business name and contact details

Inconsistent data can result in application rejection or further scrutiny by the FTA.

5. Delaying Responses to FTA Requests

Timely responses are crucial. Ignoring FTA queries or taking too long to reply may cause application delays or lead to cancellation.

6. Poor Record-Keeping

Maintain clean, verifiable documentation of:

- Sales and purchase invoices

- VAT paid/charged

- Financial statements

Good record-keeping not only supports your TRN number UAE application but also ensures smooth audits and compliance checks.

Who Is Eligible to Get a TRN in the UAE?

Eligibility for a TRN in the UAE depends entirely on your business activities and meeting specific financial criteria. Any business engaged in taxable activities should register for a TRN if its annual turnover exceeds the defined threshold.

How Long Does It Take to Get a TRN Certificate in the UAE?

It takes about 20 business days to process your application and receive your Tax Registration Number (TRN) upon approval. However, the process may take longer if the FTA requires additional information.

Can I Register for VAT Using My Excise Tax Registration Number?

No, you cannot use your Excise Tax Registration Number to register for VAT. After reviewing and approving your registration, the Federal Tax Authority (FTA) will assign you a specific Tax Registration Number (TRN) for VAT purposes. However, if you have already registered for Excise Tax, the process might be faster since some profile-related information could be prepopulated.

VAT Help in Dubai, UAE

Shuraa Tax is one of the leading tax consultants in Dubai. Their experts are well-trained in simplifying your company’s tax matters. Our team of professionals, including tax experts, VAT consultants, accountants, and business advisors, supports you every step of the way.

With years of experience in their respective fields, they provide solutions to meet your business needs. If you’re looking for VAT services in Dubai, we offer a wide range of solutions, including audit, accounting, VAT registration, and more. Contact us at +971508912062 or info@shuraatax.com.

FAQs

Q1. What is the full form of TRN in the UAE?

The full form of TRN is Tax Registration Number. It is a unique 15-digit identifier issued by the UAE Federal Tax Authority (FTA) to individuals and businesses registered under VAT. A TRN number is essential for issuing VAT-compliant invoices, filing tax returns, and ensuring overall VAT compliance.

Q2. Who is required to apply for a TRN in the UAE?

Any business whose annual taxable supplies exceed AED 375,000 must register for VAT and obtain a TRN in the UAE. Companies with taxable supplies above AED 187,500 can voluntarily register for VAT and get a TRN.

Q3. What are the steps to apply for TRN registration in Dubai or across the UAE?

To apply for a TRN number in the UAE, follow these steps:

- Visit the [FTA Portal]

- Create an account and log in

- Fill out the VAT registration form with accurate business and financial details.

- Upload the required documents

- Apply for FTA review and approval

This is the standard TRN registration Dubai process, applicable across the UAE.

Q4. What documents are required for TRN registration in the UAE?

To complete your TRN application, you will need:

- Valid Trade License

- A passport copy of the business owner/partners

- Emirates ID

- Proof of business address

- Latest financial statements or revenue details

These documents help the Federal Tax Authority (FTA) assess your VAT eligibility.

Q5. How long does it take to get the TRN number after applying?

Typically, the FTA processes TRN applications within 20 business days. Once approved, your TRN tax registration number will be issued and shared through your registered account on the FTA portal.

Q6. How can I verify my TRN number in the UAE?

You can verify any TRN number UAE by visiting the official FTA website. Use the VAT verification tool, enter the TRN, and check its validity instantly.

Q7. Can I apply for a TRN online in the UAE?

Yes, the entire TRN registration process is conducted online through the FTA’s official portal. It’s a simple and efficient digital process accessible to all eligible businesses.

Q8. What should I do if my TRN application is rejected?

If your TRN application is rejected, carefully review the rejection message from the FTA. Correct any missing or inaccurate information, provide additional documentation, and resubmit your application.

Q9. What’s the difference between a TRN number and VAT number?

There is no difference between a TRN number and a VAT number in the UAE. They are interchangeable terms that refer to the same Tax Registration Number issued by the Federal Tax Authority for VAT-related purposes.

Q10. What is a Tax Registration Number in the UAE?

The Tax Registration Number (TRN) is a mandatory identifier for VAT-registered businesses in the UAE. It links your business to your VAT filings and requires you to issue tax invoices, claim input VAT, and maintain compliance.