As the UAE continues to build a stronger tax and regulatory system, having a Tax Identification Number (TIN) — also called a Tax Registration Number (TRN) – is becoming essential. Whether you own a business or work as a freelancer, getting a TIN/TRN helps you stay compliant with UAE tax laws and makes financial transactions smoother.

In this blog, we’ll break down everything you need to know about the TIN/TRN in the UAE — who needs it, how to apply, and why it matters.

What is the TIN Number in UAE?

The TIN number in UAE, or Tax Identification Number, is a unique identifier assigned by the Federal Tax Authority (FTA) to entities and individuals for tax purposes. It plays a crucial role in identifying taxpayers and tracking their obligations under UAE tax laws.

In the UAE, the TIN is often used interchangeably with the TRN (Tax Registration Number); however, there is a subtle distinction, which we’ll cover later.

Who Needs a TIN Number in the UAE?

A Tax Identification Number (TIN) in the UAE is mainly required for individuals and businesses involved in taxable or internationally reportable activities. Here’s a breakdown:

For Businesses

1. Companies Registered Under UAE VAT Law

Any business that has registered for VAT (Value Added Tax) must obtain a TIN. This is crucial for filing tax returns, invoicing, and other compliance-related processes.

2. Free Zone and Mainland Businesses Exceeding the VAT Threshold

If a business (whether in a free zone or on the mainland) earns more than the mandatory VAT registration threshold (currently AED 375,000 per annum), it must register for VAT. It will be issued a Tax Identification Number (TIN).

3. Import-Export Businesses

Companies involved in importing or exporting goods are often required to have a Taxpayer Identification Number (TIN) to comply with customs and tax regulations, especially when trading with VAT-registered entities.

For Individuals

1. Freelancers and Sole Proprietors Offering Taxable Goods or Services

If you’re a freelancer or operate as a sole trader providing services or products that fall under VAT, you’ll need to register and obtain a TIN.

2. UAE Residents with International Income (for Tax Reporting Abroad)

Residents who earn income outside the UAE and are subject to tax reporting in other countries, such as those under FATCA or CRS, may need a UAE Tax Identification Number (TIN) for foreign tax compliance purposes.

3. Foreign Nationals Conducting Business in the UAE

Non-residents or foreign entrepreneurs operating a business within the UAE (e.g., through free zones) and engaging in taxable activities are also required to obtain a TIN.

Special Note for Individuals

If you’re specifically looking for the UAE TIN number for individuals, it generally applies if you’re:

- Engaged in any taxable business or freelance activity.

- Subject to international tax reporting laws, such as the Foreign Account Tax Compliance Act (FATCA) or Common Reporting Standard (CRS), which require the disclosure of tax information to other countries.

Who Is Eligible to Get a VAT Tax Number in UAE?

To obtain a VAT Tax Registration Number (TRN) in the UAE, businesses must fall under at least one of the following categories:

1. Mandatory Registration

Your business must register for VAT if:

- Your annual taxable turnover exceeds AED 375,000.

- This includes revenue from goods and services that are subject to VAT at either 5% or 0%.

2. Voluntary Registration

Your business can choose to register if:

- Your annual taxable turnover exceeds AED 187,500 but is less than AED 375,000.

- This is ideal for startups or small businesses looking to establish credibility and recover input VAT.

3. Import/Export Businesses

- Companies involved in importing or exporting goods and services, even if the goods are zero-rated, are required to register.

- VAT compliance is crucial for smooth customs clearance and international trade.

4. Businesses in Designated Free Zones

- Businesses operating in designated free zones that deal with taxable goods or services are required to register for a Tax Registration Number (TRN).

- Although certain free zone areas have special VAT treatments, TRN is still needed if taxable supplies are involved.

Importance of Tax Identification Number (TIN) for Businesses in the UAE

A Tax Identification Number (TIN)—commonly referred to as a tax number in Dubai or the United Arab Emirates—is a vital requirement for businesses operating in the region. Here’s why it’s so important:

1. Accurate VAT Return Filing

The TIN allows businesses to file their VAT returns correctly and on time with the Federal Tax Authority (FTA). This ensures transparency in all tax-related matters and helps avoid unnecessary fines.

2. Legally Compliant Business Operations

With a TIN, businesses can operate within the legal framework of the UAE’s taxation system. It acts as proof of tax registration, which is essential for legitimate and credible operations.

3. Smooth Import and Export

A registered TIN is necessary for customs clearance during import and export activities. It helps businesses avoid regulatory hurdles and ensures that cross-border transactions go smoothly.

4. Avoidance of Penalties

Businesses that fail to register for tax or misreport their tax obligations risk heavy penalties. A TIN helps them comply with FTA requirements and avoid financial and legal consequences.

5. Builds International Trust

Having a TIN adds to a business’s credibility with international clients, suppliers, and banks. It signifies that the company is tax-compliant and transparent, key traits for building cross-border partnerships.

6. Crucial for Invoicing and Audits

Whether you’re a freelancer or a company, a UAE tax identification number is critical for issuing VAT-compliant invoices, maintaining proper tax records, and responding to audits by the authorities.

In summary, the TIN in the UAE is not just a formality—it’s a core requirement for lawful, efficient, and reputable business operations.

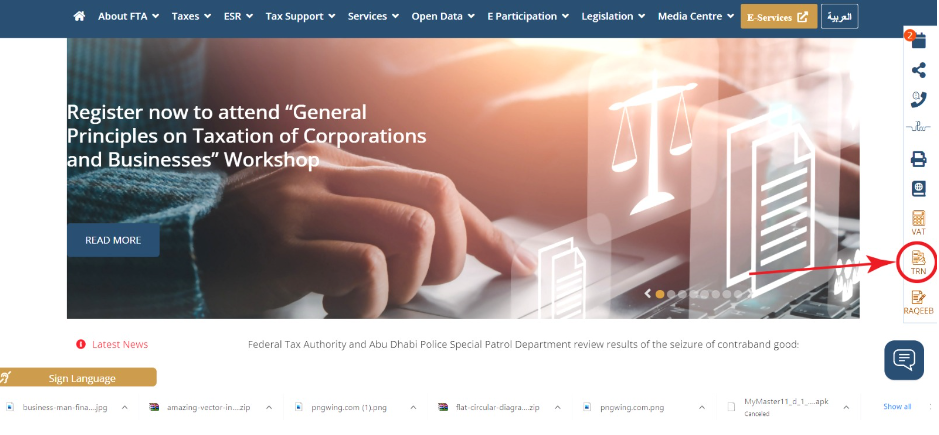

How to Get a TRN Number Online in UAE

If you’re planning to operate a business in the UAE and your taxable turnover meets the threshold, obtaining a TRN (Tax Registration Number) is mandatory. Here’s how you can get your TRN number online through the Federal Tax Authority (FTA) portal:

Step 1: Create an FTA Account

Start by visiting the FTA e-Services Portal.

Click on Sign up and fill in the basic details such as:

- Email address

- Mobile number

- Username and password

You’ll receive a verification link via email or SMS. Once verified, your account will be activated.

Step 2: Log in to Your FTA Dashboard

Use your credentials to log in. Once inside your FTA dashboard:

- Look for the ‘VAT Services’ tab.

- Click on ‘Register for VAT’ to begin your application.

Step 3: Fill in the VAT Registration Form

Complete the online form by providing the following details:

Business Information

- Registered business name (as per your trade license)

- Legal structure (LLC, Sole Establishment, etc.)

- Trade license number and issuing authority

- Business address and contact details

Financial Details

- Projected or actual taxable turnover (must exceed AED 375,000 for mandatory registration)

- Details of imports/exports if applicable

- Description of business activities

Banking Information

- Bank name

- IBAN (International Bank Account Number)

Managerial Contacts

- Details of business owners or managers (Emirates ID/passport info)

Step 4: Upload Required Documents

You must scan and upload the following documents (formats: PDF, JPEG, etc.):

- Trade license copy

- Passport and Emirates ID of owners/partners

- Proof of business address (e.g., tenancy contract or utility bill)

- Financial statements or invoices proving turnover

- Bank account letter or statement

- Customs code certificate (if importing/exporting)

Step 5: Review and Submit the Application

Double-check all your entries and uploaded documents.

Once satisfied:

- Click Submit

- You will receive an Application Reference Number and a confirmation email.

Step 6: FTA Review and TRN Issuance

The FTA will review your application, which usually takes 5–20 business days. If approved, your TRN (Tax Registration Number) will be issued and visible in your FTA dashboard. You’ll also get an official VAT Certificate.

Documents Required for Online TIN Registration in UAE

To successfully register and get your TRN/TIN, prepare the following documents:

- Copy of Trade License

- Emirates ID and Passport copy of the owner/partners

- Business contact details (email, mobile)

- Bank account details

- Custom code certificate (if applicable)

- Turnover proof (bank statements, audited accounts, etc.)

- Memorandum of Association (MOA)

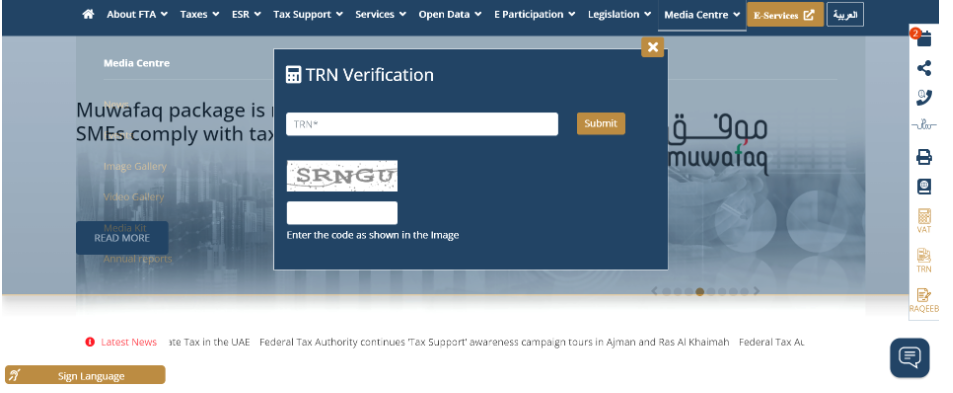

How to Verify TIN Number Online in UAE?

Once issued, you can verify your TIN in the UAE through:

- Visiting the FTA TRN Verification Tool.

- Enter the TRN number to confirm its validity.

- This ensures that you’re dealing with VAT-registered entities.

Difference between TIN and TRN in UAE

Here’s a clear table highlighting the difference between TIN and TRN in the UAE:

| Aspect | TIN (Tax Identification Number) | TRN (Tax Registration Number) |

|---|---|---|

| Full Form | Tax Identification Number | Tax Registration Number |

| Issued By | Federal Tax Authority (FTA) or the relevant authority for international reporting | Federal Tax Authority (FTA), UAE |

| Who Needs It | Individuals and businesses with international tax obligations | Businesses in the UAE meeting the VAT registration threshold |

| Usage Scope | Broad — for global tax reporting, FATCA, CRS, banking, etc. | Narrow — specific to VAT returns, invoicing, and tax compliance in UAE |

| Format | Not publicly standardized; varies based on type | 15-digit number (e.g., 100123456700003) |

| Applies To Individuals? | Yes, especially those with foreign income or reporting needs | No, unless the individual is running a taxable business or freelance activity |

| Applies To Businesses? | Yes, especially those involved in cross-border operations | Yes, for businesses with taxable supplies exceeding AED 375,000 annually |

| Registration Requirement | Not always mandatory unless dealing with international tax matters | Mandatory for businesses exceeding the VAT threshold in UAE |

| Main Legal Reference | OECD guidelines, FATCA, CRS regulations | UAE VAT Law and FTA regulations |

In essence, the TIN number in the UAE, TRN, and VAT number often refer to the same number assigned by the FTA; however, TIN can also refer to identifiers used for international tax compliance.

What is the Processing Time to Obtain a TRN Certificate in the UAE?

After submitting your VAT registration, the typical processing time is 5–20 business days, depending on the completeness and accuracy of your application. Upon approval, the TRN certificate will be available for download via the FTA dashboard.

Understanding Tax Registration!

Whether you’re a business owner or an individual involved in taxable services, obtaining your TIN number in UAE is a crucial step toward tax compliance and smoother operations. Understanding the process, documents, and differences between TIN, TRN, and VAT numbers can save you time and ensure regulatory peace of mind.

Need help registering for your UAE TIN or VAT number?

Let the experts at Shuraa Tax guide you through the hassle-free process.

📞 Call: +(971) 44081900

💬 WhatsApp: +(971) 508912062

📧 Email: info@shuraatax.com

Note: The information provided above is for educational purposes only. For professional assistance with TRN registration in the UAE, Shuraa Tax is here to help.