Navigating accounting challenges is no easy task for businesses, especially with the ever-evolving UAE tax regulations and payroll details. Small businesses often need help to keep up, and the costs can quickly increase. That’s why many turn to trusted accounting firms in Dubai for help.

According to Shuraa Tax, it’s not uncommon for one out of every three companies in Dubai to seek external bookkeeping services. Outsourcing these tasks doesn’t just ensure compliance; it also empowers better financial decision-making. Among these firms, Shuraa Tax shines as a standout choice. If you’re curious to learn more about what sets them apart, keep reading this guide on the best accounting firms in Dubai.

Audit in Dubai: Why It’s Crucial for Businesses and How to Choose the Right Firm

As Dubai continues to rise as a global business hub, companies operating in the emirate are expected to maintain financial transparency, accuracy, and compliance with local laws and regulations. This is where audits play a vital role. Conducting regular audits in Dubai not only enhances financial credibility but also ensures legal compliance with the UAE Commercial Companies Law and various free zone regulations.

Whether you’re a startup, SME, or multinational enterprise, partnering with a reliable accounting firm in Dubai can help streamline your audit process and align your financial operations with international standards.

What is an Audit and Why is it Important?

An audit is an independent examination of an organisation’s financial records, internal processes, and compliance with relevant regulations. The objective is to ensure the accuracy and reliability of financial statements, detect fraud, and verify compliance with applicable standards.

Key Reasons for Conducting an Audit in Dubai:

- Legal Requirement: Many free zones and the mainland mandate annual audits for business license renewal.

- Transparency for Investors: Audits build investor confidence, which is crucial for raising capital or entering partnerships.

- Risk Mitigation: Helps detect financial irregularities early and improves internal control systems.

- Tax Compliance: With VAT and corporate tax now in place, audits ensure accurate tax reporting and help avoid penalties.

Role of Accounting Firms in the Audit Process

Professional accounting firms in UAE play an essential role in the audit process. These firms employ certified auditors and financial experts who utilise global standards, such as IFRS, to examine financial statements, generate audit reports, and provide financial insights.

A qualified accounting firm Dubai can offer:

Choosing from among the top accounting companies in Dubai ensures your business complies with legal obligations and maintains operational integrity.

Choosing the Right Accounting Firm in Dubai

Given the number of accounting companies in Dubai, selecting the right one for your audit needs can be overwhelming. Here are some tips:

1. Check for Certification & Licensing

Ensure the firm is registered with the relevant authorities, such as the UAE Ministry of Economy, and recognised by the free zone regulators.

2. Industry Experience

Top bookkeeping firms in Dubai and auditors with experience in your industry are better positioned to understand your unique business processes.

3. Service Portfolio

Apart from audits, look for firms that offer tax consultancy, VAT services, payroll processing, and accounting software integration for end-to-end support.

4. Client Reputation

Explore reviews, testimonials, and case studies to gauge a firm’s reliability. Leading firms often serve international clients and comply with global standards.

Benefits of Hiring Top Tax Firms and Bookkeeping Firms in Dubai

Working with top tax firms in Dubai offers added benefits beyond audits. These firms help you:

- Prepare and file VAT and corporate tax returns

- Maintain updated financial records

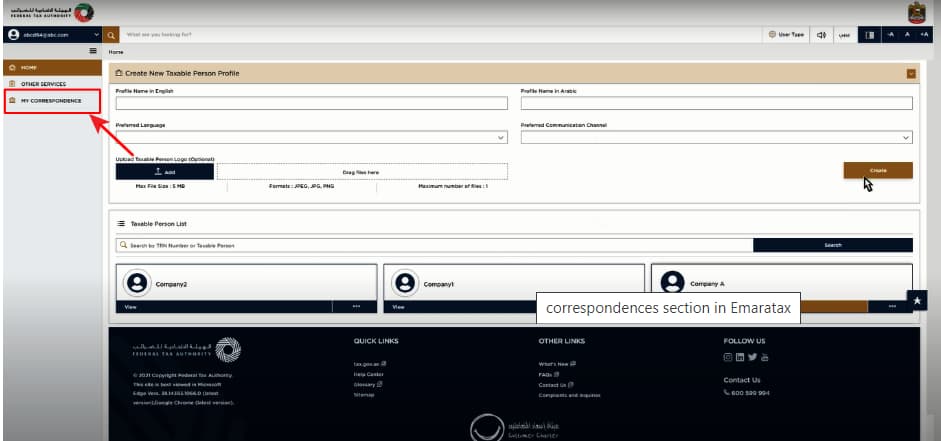

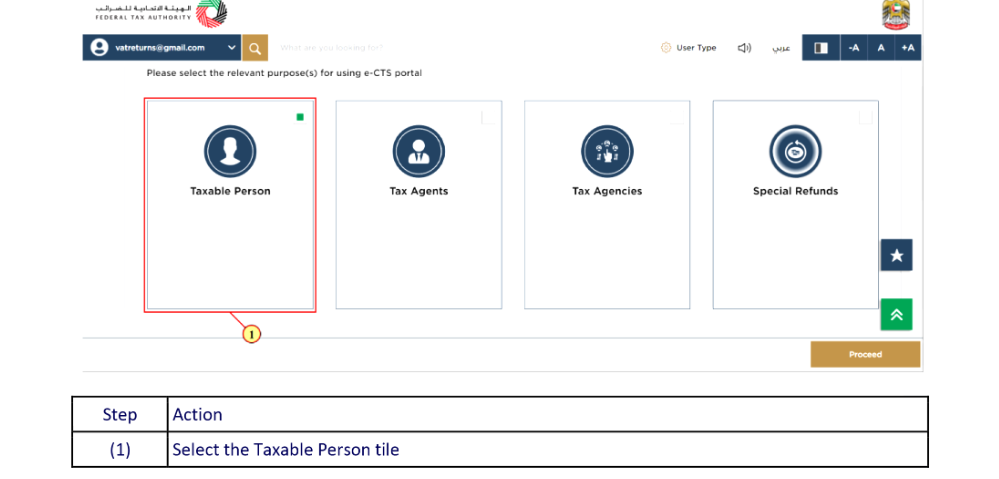

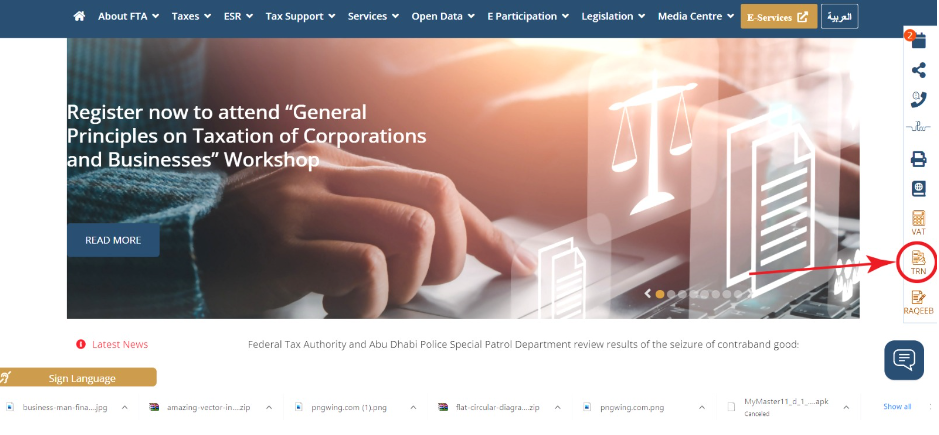

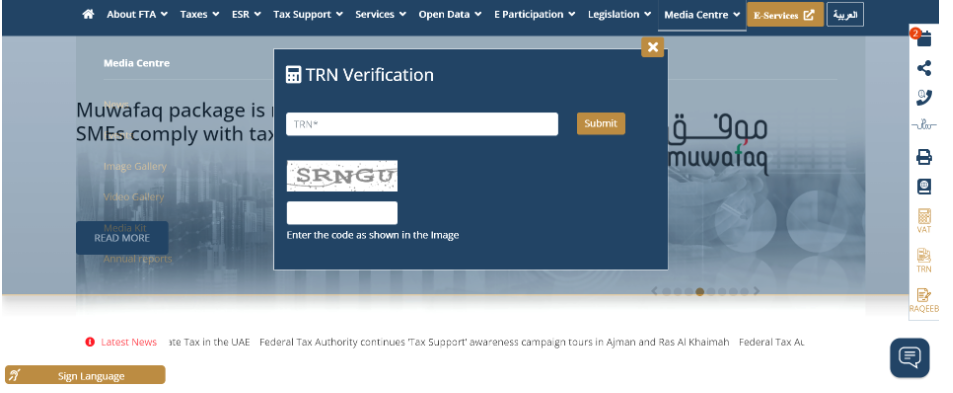

- Ensure compliance with FTA (Federal Tax Authority) guidelines

- Reduce tax liabilities through strategic planning

Similarly, bookkeeping firms in Dubai play a pivotal role in maintaining daily financial transactions, reconciling bank statements, and ensuring audit readiness.

Top 20 Audit Firms in Dubai, 2025

The top 20 audits firms in Dubai are as follows:

1. Shuraa Tax

Shuraa Tax Consultants and Accountants, one of the best accounting firms in Dubai, offers various services to support your company’s financial needs. These services include maintaining accurate bookkeeping records, auditing financial statements, providing guidance on investment banking, navigating tax litigation, and staying updated on regulatory policies.

Additionally, Shuraa’s tax consultants prioritise exceptional client service. In Dubai, Shuraa tax consultants, recognised among the top accounting firms in the UAE, assess your current tax situation for effective planning and oversee your company’s bookkeeping to ensure you always have the required records and registrations.

Services offered by Shuraa Tax include:

- Implementation of UAE VAT

- Registration for UAE VAT

- Tax agency services registered in the UAE

- Business setup and tax advisory

- Various other financial services

2. A&A Associate LLC

For accounting services in Dubai, consider A&A Associate LLC. With over 15 years of experience, their team of chartered accountants provides customised services to meet your needs. They offer a range of services, including bookkeeping, tax services, and internal audits.

Their packages start at AED 999 per month, covering up to 50 monthly transactions and including free VAT and ESR assessments. A&A Associate LLC also provides a free consultation to help you determine if their services are the right fit for your business.

3. Abdulla Al Mulla Auditing & Accounting (AM Audit)

Established in 2016, AM Audit serves large corporations and SMEs with a comprehensive suite of accounting services, including financial accounting, payroll, and inventory management. They also offer an Accounting Software Service, which includes installing and supporting popular software packages like Sage, QuickBooks, and SAP.

Clients can use the website’s live chat function to address any questions. Additionally, AM Audit provides a free information library on UAE tax rules, covering topics from VAT regulations to business laws across different zones.

4. Aviaan Accounting

Aviaan Accounting collaborates with multinational corporations across the US, Europe, the Middle East, and India, serving various industries, including retail, trading, oil & gas, construction, and healthcare. They offer a range of services, including basic bookkeeping, financial statement reconciliation, tax filing, and audit preparation. Additionally, Aviaan Accounting assists clients in setting up bookkeeping systems and using accounting software.

They also conduct feasibility studies to help businesses assess the financial viability of new ventures. Their case studies highlight their success in transforming loss-making companies into profitable enterprises.

5. BMS Auditing

MBS Auditing, an international bookkeeping firm headquartered in Dubai, serves clients in diverse industries, including construction and financial services. Adhering to IFRS and GAAP guidelines, it utilises advanced bookkeeping software. Their comprehensive services comprise:

- Audit services

- Accounting services

- VAT services

- Corporate tax services

- Excise tax services

With customer support available 24/7, including weekends, they prioritise client satisfaction. Moreover, their website features an ‘Insights’ section offering free resources, including the latest regional business news and valuable accounting tips for companies.

6. Creative Zone Tax & Accounting

Creative Zone Tax & Accounting operates under the umbrella of Creative Zone, a Dubai-based formation specialist firm. Providing a plethora of financial reporting services, their offerings encompass:

- Basic accounting and bookkeeping

- VAT registrations

- Tax filings

- Company audits

The standard accounting setup package has an initial fee of AED 1,500 for the first year, which is waived if you continue utilising their accounting services thereafter. Transparent pricing for various services is available online, enabling customers to select a tailored package based on their individual needs.

7. Emirates Chartered Accountants Group (ECAG)

Based in Dubai, ECAG boasts branches across the UAE, the UK, Bahrain, and India, with nearly two decades of operational experience. Specialising in serving SMEs across diverse sectors, its chartered accountants provide on-site visits on a weekly or monthly basis and offer daily online communication. Their comprehensive services encompass:

- Accounting and financial reporting

- Backlog accounting

- Fixed asset management

- Standard operating procedures

- Inventory verification

Renowned for its auditing prowess, ECAG offers both internal and external audits. Additionally, it extends its expertise to business setup assistance, including support for mergers and acquisitions.

8. Hashtag Startup

Hashtag Startup offers advisory services tailored for corporates and entrepreneurs, with accounting services being just one facet of its comprehensive offerings. Despite their relative portion, their accounting services effectively address most small business accounting requirements. Clients benefit from an online portal that enables access to accounting data and facilitates inquiries.

Beyond fundamental accounting support, Hashtag Startup stands out for its licensing services. It provides expert guidance throughout the license registration process, encompassing industry-specific licenses to commercial licenses. Moreover, the company extends CFO services to assist clients in financial management.

9. HLB HAMT

Top accounting firms in Dubai often provide onsite bookkeeping services, and HLB HAMT is no exception, offering this option alongside online or cloud-based accounting solutions. Additionally, they help with accounting system setup and training.

With a history dating back to 1999, HLB HAMT is a well-established firm in the UAE and a proud member of HLB International, a global advisory and accounting network. Their expertise spans various industries, including:

- Logistics

- Retail sector

- Hospitality and healthcare

- Manufacturing and distribution

- Construction and real estate KGRN

Among the array of accounting companies in Dubai, KGRN is a prominent choice. Established in the UAE in 2007, it boasts membership in Integra International, a network spanning 74 countries. KGRN’s comprehensive accounting services encompass:

- Bookkeeping

- Financial reporting and analysis

- Compliance regulations

- Tax filing

Clients can leverage their cloud accounting service through the FinancialForce Accounting platform, which seamlessly integrates with the widely used Salesforce Platform.

10. Charles & Darwish Associates

Charles & Darwish Associates is a reputable accounting firm in Dubai, offering customised financial and tax solutions for businesses across various sectors. With a strong commitment to accuracy, compliance, and client satisfaction, the firm delivers end-to-end support in auditing, VAT consulting, tax planning, and financial advisory. Backed by a team of experienced professionals, Charles & Darwish helps businesses navigate the complexities of the UAE’s financial regulations with confidence and clarity.

As a well-established accounting firm in Dubai, Charles & Darwish Associates ensures that every client receives personalised attention and strategic insights for optimal financial performance. From managing daily bookkeeping to advising on corporate tax structures, the firm stands out among accounting firms in the UAE for its reliability and results-driven approach.

Core Services Offered by Charles & Darwish Associates:

- Financial auditing and internal controls

- UAE VAT registration and filing

- Business tax advisory and planning

- Full-service bookkeeping and payroll management

- Risk analysis and compliance consulting

- Business setup and financial structuring

- Virtual CFO and strategic financial guidance

11. Ernst & Young (EY)

Ernst & Young, commonly known as EY, is a globally recognised professional services organisation and a top-tier accounting firm in Dubai. With decades of international expertise and a deep understanding of local markets, EY offers comprehensive financial solutions to help businesses grow, comply, and transform. Their services span across assurance, tax advisory, consulting, and strategy, empowering clients with data-driven insights and sustainable value.

As a trusted accounting firm in Dubai, EY delivers specialised support in areas such as corporate tax planning, transfer pricing, business performance improvement, VAT compliance, and financial audits. Their Dubai office serves as a regional hub, supporting a wide spectrum of industries—from government and energy to real estate, technology, and financial services.

Key Services Provided by Ernst & Young (EY):

- Financial and statutory audits

- Tax planning and advisory (corporate, VAT, transfer pricing)

- Business setup and regulatory compliance

- Risk management and internal controls

- Mergers & acquisitions and transaction advisory

- Sustainability and ESG consulting

- Digital transformation and technology advisory

EY’s commitment to quality, innovation, and integrity has positioned it among the top accounting firms in the UAE, trusted by global enterprises and local startups alike.

12. Jitendra Chartered Accountants

Jitendra Chartered Accountants (JCA) is a well-established and highly respected accounting firm in Dubai, offering expert financial, accounting, and tax consulting services customised for businesses of all sizes. With over two decades of experience in the UAE market, JCA has built a strong reputation for accuracy, compliance, and client-focused solutions.

As a prominent accounting firm in Dubai, JCA assists clients with seamless VAT implementation, internal audits, financial restructuring, and company formation advisory. Their deep knowledge of UAE laws and regulations ensures that clients remain compliant while improving operational efficiency and financial transparency.

Services Offered by Jitendra Chartered Accountants:

- Financial audits and internal controls

- VAT registration, filing, and compliance

- Corporate tax advisory and planning

- Bookkeeping and accounting services

- Business setup and offshore company formation

- Economic Substance Regulation (ESR) compliance

- Anti-Money Laundering (AML) advisory

Recognised among the reliable accounting firms in the UAE, Jitendra Chartered Accountants takes a proactive approach in guiding businesses through evolving tax frameworks and financial obligations, ensuring they stay competitive and compliant.

13. Deloitt

Deloitte is one of the “Big Four” professional services firms and a globally trusted accounting firm in Dubai, offering a full spectrum of financial, tax, risk, and advisory services to businesses across all industries. With a strong regional presence and a reputation for excellence, Deloitte supports clients in navigating complex regulatory landscapes while driving innovation and growth.

As a premier accounting firm in Dubai, Deloitte combines global expertise with local market knowledge to deliver strategic insights, robust compliance, and forward-thinking solutions. Whether it’s corporate tax planning, VAT advisory services, or internal audits, Deloitte’s team of professionals ensures that every service is delivered with accuracy, efficiency, and integrity.

Core Services Offered by Deloitte in Dubai:

- Financial and statutory audits

- Corporate tax advisory and UAE VAT compliance

- Risk assessment and internal control development

- Mergers & acquisitions and due diligence

- Business performance and transformation consulting

- Cybersecurity and technology advisory

- ESG and sustainability services

Deloitte’s commitment to quality and innovation has solidified its standing as a top accounting firm in Dubai, trusted by multinational corporations, government entities, and regional enterprises.

14. KGRN Chartered Accountants

KGRN Chartered Accountants is a reputable accounting firm in Dubai, recognised for delivering expert financial, tax, and business advisory services tailored to meet the diverse needs of clients across various industries. With a strong focus on regulatory compliance, client satisfaction, and financial accuracy, KGRN has positioned itself as a trusted partner for both startups and established businesses in the UAE.

As a client-centric accounting firm in Dubai, KGRN offers personalised solutions that support strategic growth while ensuring adherence to local and international accounting standards. Their team of qualified professionals brings extensive knowledge in UAE VAT regulations, corporate taxation, and business structuring, enabling clients to operate efficiently and confidently.

Key Services Offered by KGRN:

- Accounting and bookkeeping services

- VAT registration and compliance

- Corporate and personal tax advisory

- Audit and assurance services

- Company formation and business setup

- ESR (Economic Substance Regulations) and AML compliance

- Virtual CFO services and financial consulting

Recognised among the dependable accounting firms in the UAE, KGRN Chartered Accountants focuses on proactive planning and practical insights, helping businesses stay financially healthy and compliant with legal requirements in a competitive market.

15. Farahat & Co

Farahat & Co is a distinguished accounting firm in Dubai with over 35 years of industry experience, offering a wide range of financial, tax, and business advisory services. Known for its professionalism, transparency, and commitment to compliance, Farahat & Co serves a diverse clientele, including SMEs, multinational corporations, and government entities across the UAE.

As a highly regarded accounting firm in Dubai, Farahat & Co provides end-to-end solutions, from auditing and bookkeeping to business setup and legal consulting. Their multidisciplinary team ensures that clients receive tailored advice aligned with the latest regulatory updates, enabling them to achieve financial clarity and long-term success.

Core Services Provided by Farahat & Co:

- External and internal audit services

- VAT registration, filing, and compliance

- Corporate tax advisory and structuring

- Bookkeeping and payroll processing

- Business incorporation and licensing

- PRO and legal translation services

- HR, recruitment, and employee outsourcing

Farahat & Co stands out among the top accounting firms in the UAE for combining technical expertise with a deep understanding of local business practices, making it a trusted partner for companies looking to thrive in the Dubai market.

16. EBS

Emirates Business Setup (EBS) is a full-service accounting firm in Dubai, providing comprehensive business and financial solutions to entrepreneurs, SMEs, and corporations throughout the UAE. With a strong focus on accuracy, compliance, and strategic support, EBS simplifies complex financial processes and ensures businesses are structured for sustainable growth.

EBS is more than just an accounting firm in Dubai—it acts as a strategic partner in helping clients manage VAT obligations, maintain precise bookkeeping, and navigate the UAE’s evolving tax laws. The firm’s expert consultants also guide business owners through licensing, company formation, and ongoing compliance requirements, making it a one-stop destination for business setup and financial management.

Key Services Offered by EBS:

- Accounting and bookkeeping services

- VAT registration, advisory, and return filing

- Corporate tax planning and compliance

- Internal and external audit services

- Business setup and PRO services

- Company liquidation and restructuring

- ESR and AML compliance consulting

As a trusted accounting firm in Dubai, EBS combines financial expertise with business insight to support companies at every stage—from formation to expansion—ensuring compliance, clarity, and continued success.

17. Emirates Chartered Accountants Group

Emirates Chartered Accountants Group, commonly known as EmiratesCA, is a leading accounting firm in Dubai, offering world-class financial, audit, and business advisory services to a wide range of clients, from startups to multinational corporations. With over 18 years of experience in the UAE and GCC markets, EmiratesCA is recognised for its professionalism, compliance expertise, and client-centric approach.

As a highly reputable accounting firm in Dubai, EmiratesCA is committed to helping businesses stay ahead of regulatory changes, maintain transparency in financial reporting, and make informed decisions. The firm’s team of certified auditors and consultants offers tailored solutions in tax, audit, accounting, and business consulting, making them a one-stop partner for comprehensive financial management.

Key Services Offered by EmiratesCA:

- Audit and assurance services

- VAT registration and return filing

- UAE corporate tax advisory

- Accounting and bookkeeping services

- Business setup in UAE free zones, mainland & offshore

- ESR and UBO compliance services

- Management consultancy and feasibility studies

Recognised among the top accounting firms in the UAE, EmiratesCA empowers clients with financial clarity, regulatory confidence, and strategic insight, making it a reliable choice for businesses aiming to grow sustainably in the region.

18. RBS Accounting Firms

RBS Accounting Firms is a trusted accounting firm in Dubai delivering expert financial and business advisory solutions tailored to the needs of startups, SMEs, and large enterprises across the UAE. Known for its precision, transparency, and client-centric approach, RBS provides a comprehensive suite of services to help companies maintain regulatory compliance and achieve financial efficiency.

As an experienced accounting firm in Dubai, RBS specialises in providing accurate bookkeeping, audit support, VAT advisory, and strategic tax planning. With a team of qualified professionals and deep local market knowledge, RBS empowers businesses to streamline their financial operations and make informed decisions with confidence.

Core Services Offered by RBS Accounting Firms:

- Bookkeeping and financial reporting

- VAT registration and tax filing

- Corporate tax planning and compliance

- Internal and external audit services

- Business setup and advisory in the UAE

- AML, ESR, and UBO compliance consulting

- Virtual CFO services and payroll management

RBS stands out among the top accounting firms in the UAE for its dedication to delivering timely, accurate, and compliant financial solutions, making it the go-to partner for businesses looking to grow securely in Dubai’s dynamic business environment.

19. KPMG

KPMG is a globally recognised accounting firm in Dubai, known for its unmatched expertise in audit, tax, and advisory services. As part of the prestigious “Big Four,” KPMG provides advanced solutions that help businesses across all sectors stay compliant, optimise performance, and navigate complex financial challenges in the UAE.

KPMG’s Dubai office combines global best practices with a deep understanding of regional regulations, making it a preferred partner for multinational corporations, government entities, and local businesses.

Key Services:

- Financial and statutory audits

- UAE corporate tax and VAT advisory

- Risk consulting and internal audits

- Business transformation and performance improvement

- ESG, sustainability, and technology consulting

KPMG continues to set the standard for excellence among accounting firms in the UAE, offering forward-thinking strategies to help clients stay competitive and compliant.

20. Grant Thornton

Grant Thornton is a leading international accounting firm in Dubai, offering comprehensive assurance, tax, and advisory services to help dynamic businesses unlock their growth potential. With a strong presence in the UAE, Grant Thornton serves clients across various industries, combining personalised service with global expertise.

Their approach is proactive and collaborative, enabling businesses to meet regulatory demands while identifying opportunities for operational and financial improvement.

Core Services:

- Audit and assurance

- Corporate tax and VAT compliance

- Business risk services and internal controls

- Transaction advisory and M&A support

- Strategic business consulting and restructuring

Grant Thornton’s reputation as a trusted accounting firm in Dubai stems from its commitment to quality, innovation, and measurable business impact.

Choose the Right Accounting Partner in Dubai

Selecting the right accounting firm in Dubai is essential for maintaining financial transparency, ensuring compliance, and fostering sustainable growth. Whether you’re a startup, SME, or an established corporation, partnering with the right professionals can make a significant difference.

With so many accounting companies in Dubai offering diverse services—from auditing and VAT consultation to bookkeeping and tax filing—businesses have a wide array of choices. However, opting for one of the top accounting companies in Dubai, such as Shuraa Tax, ensures that your financial matters are in the hands of trusted experts.

Shuraa Tax stands out among accounting firms in UAE for its client-centric approach, proven expertise, and comprehensive service portfolio. From being a leading bookkeeping and accounting firm in Dubai to offering strategic tax advisory services as one of the top tax firms, Shuraa Tax is a reliable partner for all your accounting needs.

Call: +(971) 44081900

WhatsApp: +(971) 508912062

Email: info@shuraatax.com

Contact Us today for personalised assistance and experience why we’re a top accounting firm in Dubai, trusted by businesses across the region.