Suppose you’re wrapping up your business in the UAE, applying for a tax refund, or even transferring ownership. Everything seems in place, but then you realize—there’s one crucial document missing: the Tax Clearance Certificate (TCC). Without it, your process could hit an unexpected roadblock, causing delays, fines, or rejected applications.

So, what exactly is a Tax Clearance Certificate? Simply put, it’s an official document issued by the Federal Tax Authority (FTA) confirming that you have no outstanding tax liabilities. It’s proof that you’ve met all your tax obligations, whether it’s VAT, corporate tax, or any other applicable taxes.

Why is it important? Think of it as your financial clean slate. If you’re closing a business, applying for government approvals, or even restructuring your company, having a TCC ensures a smooth transition.

What is a Tax Clearance Certificate in the UAE?

A Tax Clearance Certificate (TCC) is an official document issued by the Federal Tax Authority (FTA) in the UAE. It confirms that an individual or business has met all their tax obligations and has no outstanding tax liabilities, such as VAT or corporate tax. This certificate serves as proof of tax compliance and is often required in various financial and legal transactions.

Who Needs a Tax Clearance Certificate?

A Tax Clearance Certificate is essential for both businesses and individuals in specific situations. It is commonly required by:

- Business owners: When closing or liquidating a company.

- Companies undergoing mergers or acquisitions: To prove tax compliance before a business transfer.

- Individuals and businesses applying for tax refunds: To ensure there are no pending tax dues.

- Companies transferring ownership: To confirm that all tax obligations have been fulfilled.

- Businesses applying for government approvals or contracts: As part of regulatory compliance.

Situations Where a Tax Clearance Certificate is Required

A company tax clearance certificate in Dubai or UAE is often needed in the following scenarios:

1. Company Liquidation or Closure

Before shutting down a business, owners must settle all tax obligations and obtain a TCC to complete the deregistration process.

2. Change of Business Ownership

If a company is being sold or transferred, the new owners may require a TCC as proof that there are no tax liabilities.

3. Applying for Tax Refunds

If a business or individual is eligible for a tax refund, the FTA may require a TCC to confirm compliance.

4. Government or Banking Transactions

Some official processes, such as securing government contracts or financial transactions with banks, may require a TCC.

5. Restructuring or Merging a Business

Companies going through mergers or restructuring may need to present a TCC to confirm that all tax payments have been made.

Eligibility Criteria for Obtaining a Tax Clearance Certificate

To qualify for a Tax Clearance Certificate (TCC) in the UAE, businesses and individuals must meet certain requirements set by the Federal Tax Authority (FTA). Below are the key eligibility criteria:

1. Compliance with Tax Obligations

The applicant must have no pending tax liabilities related to VAT, corporate tax, or any other applicable taxes. All tax returns must be filed accurately and on time with the FTA.

2. No Outstanding Penalties or Fines

There should be no unpaid tax penalties or fines imposed by the FTA due to late filings, incorrect tax submissions, or other violations. Any outstanding dues must be settled before applying for a TCC.

3. Business Closure or Liquidation (if applicable)

If a company is closing or liquidating, it must first cancel its tax registration with the FTA. A VAT deregistration certificate may be required as part of the application process.

4. Tax Refund Applicants (if applicable)

Individuals or businesses applying for a tax refund may need a TCC to confirm that they have cleared all tax obligations.

5. Valid Trade License (for Businesses)

Businesses applying for a TCC must have a valid or recently expired trade license (depending on the reason for obtaining the certificate).

If the company has been liquidated, proper liquidation documents must be submitted.

How to Apply for a Tax Clearance Certificate in UAE?

Applying for a Tax Clearance Certificate in the UAE involves several steps to ensure all tax obligations are cleared with the FTA. Below is a simple guide to help you through the process:

1. Ensure All Tax Obligations Are Met

Check that all tax returns (VAT, corporate tax, etc.) have been filed correctly. Ensure there are no outstanding tax payments, fines, or penalties with the FTA. If there are pending dues, they must be cleared before proceeding.

2. Gather the Required Documents

Prepare the necessary documents based on your status (business or individual). These may include:

- Trade license (for businesses)

- VAT registration certificate (if applicable)

- Emirates ID and passport copy (for individuals)

- Tax payment receipts and audit reports (if required)

- Liquidation documents (if applying for business closure)

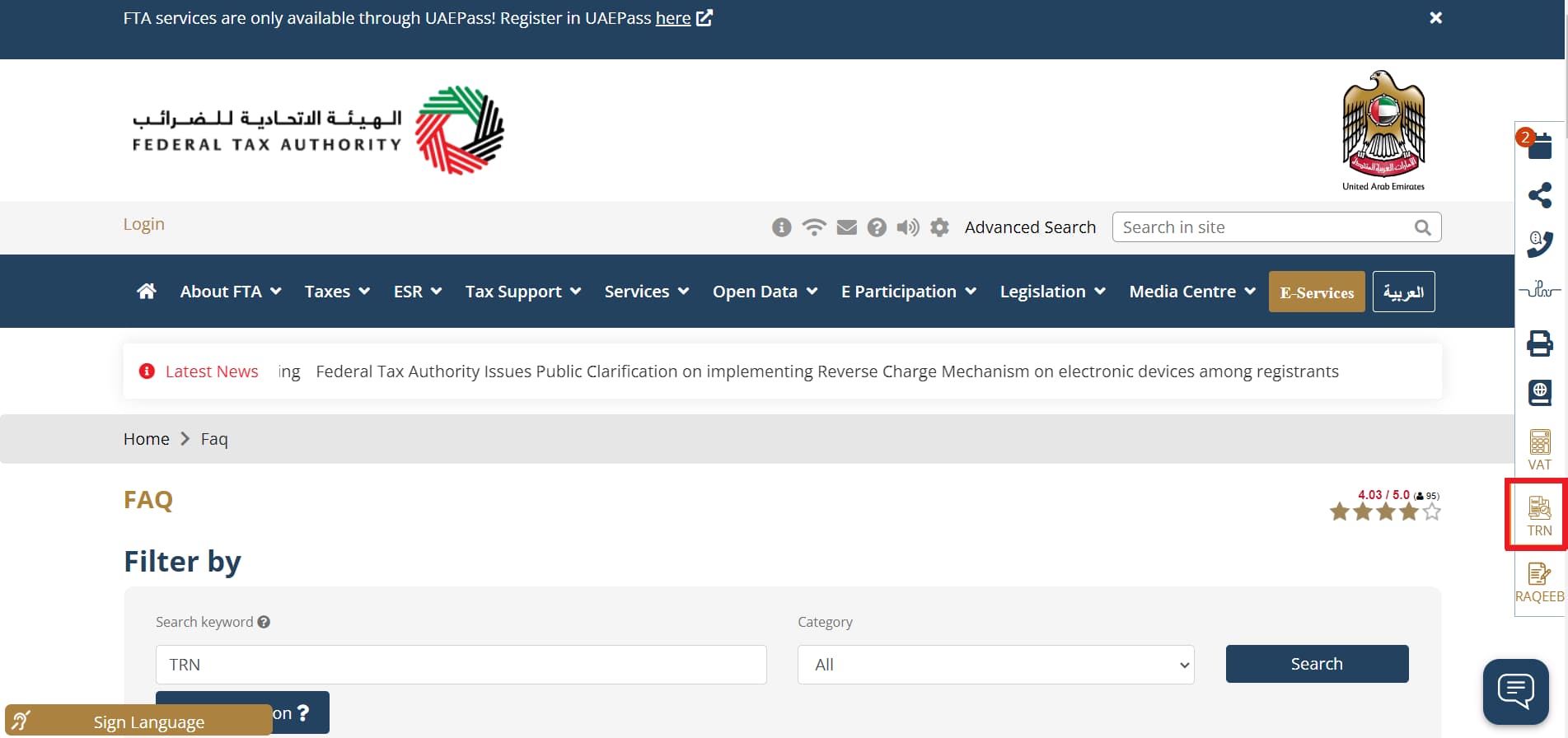

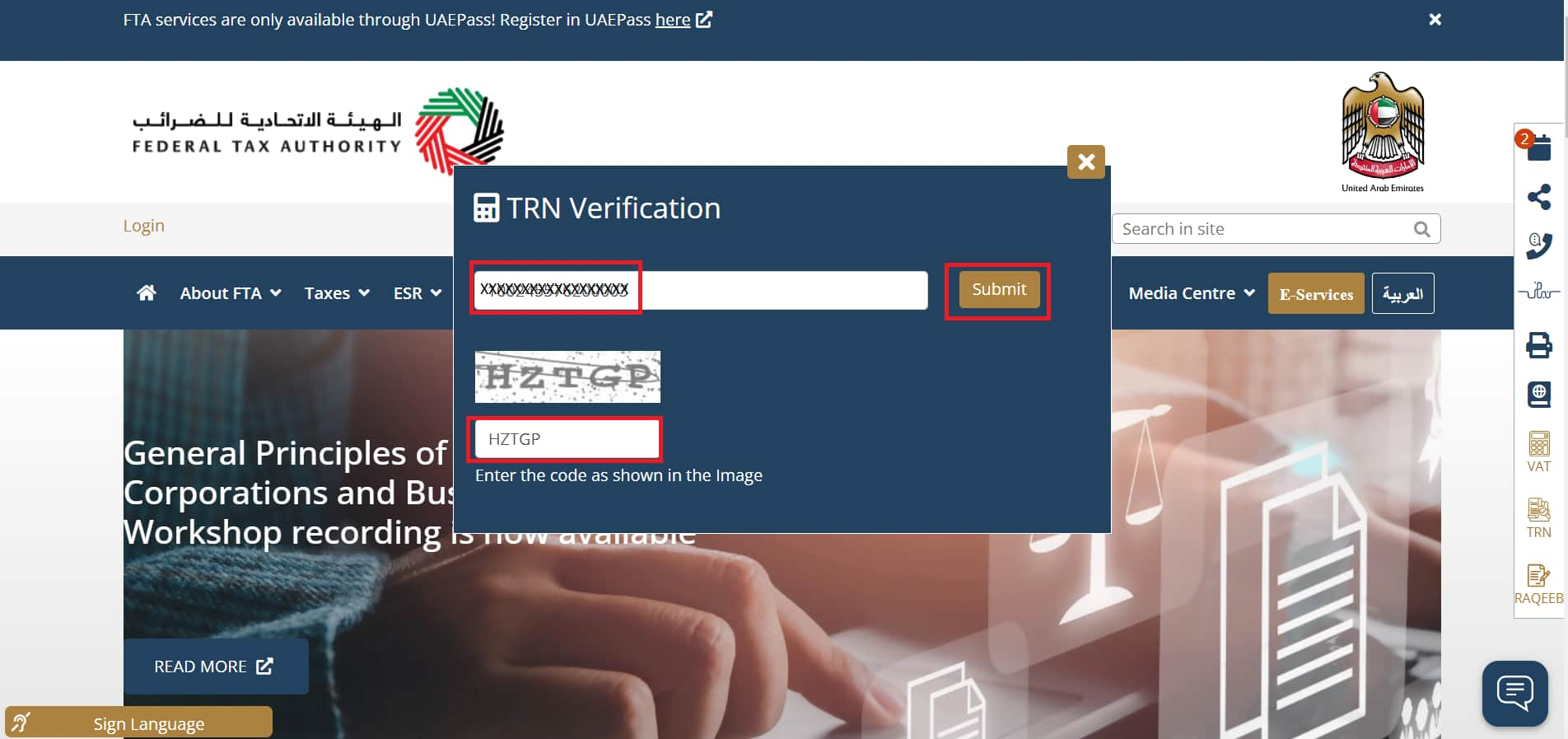

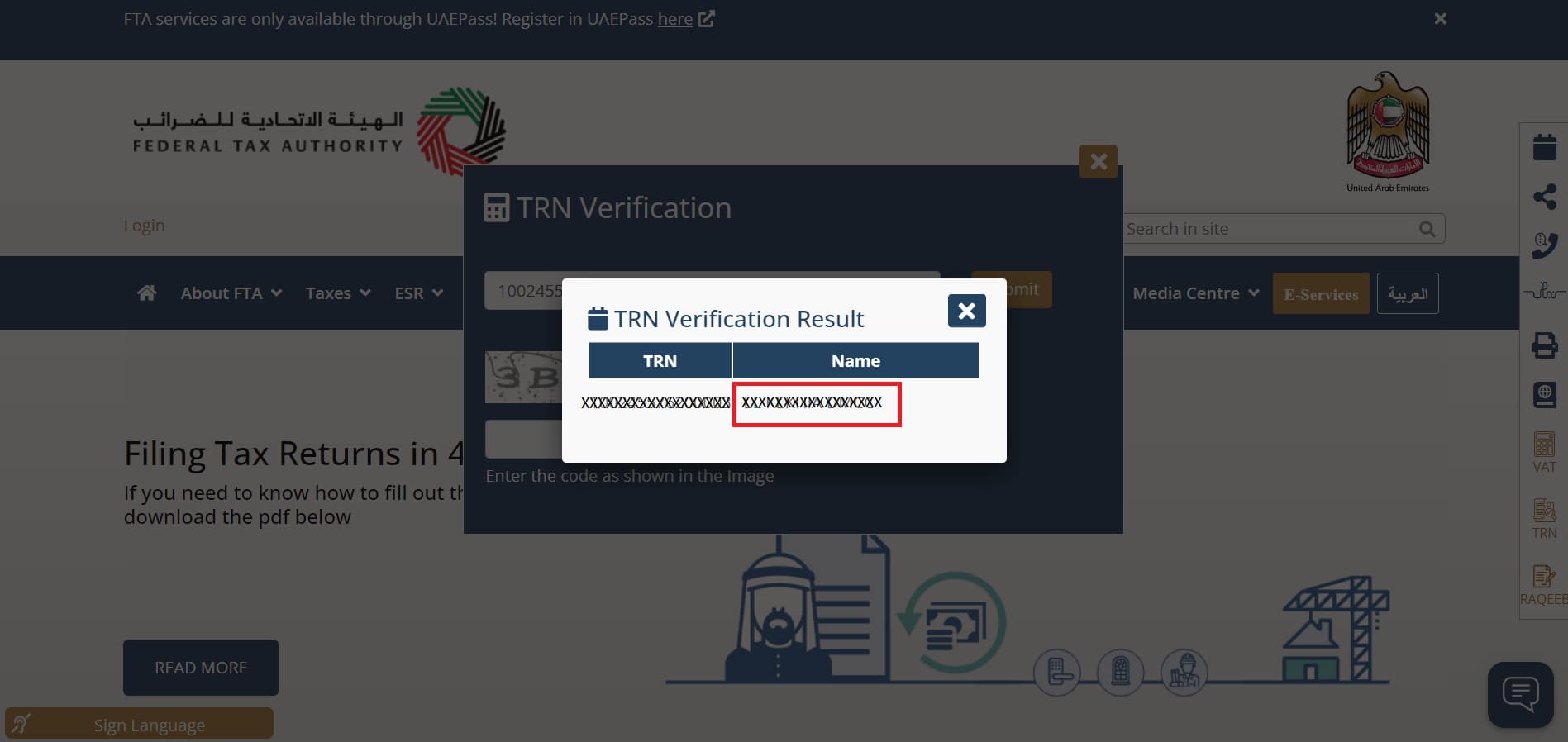

3. Submit the Application via FTA Portal

You can apply for a tax clearance certificate online.

- Log in to the Federal Tax Authority (FTA) e-Services portal.

- Navigate to the Tax Clearance Certificate section.

- Fill out the application form with accurate details.

- Upload all required documents.

4. Pay Any Applicable Fees

Some cases may require payment of processing fees to complete the application. If there are any outstanding dues, they must be settled before the application is processed.

5. Verification and Approval by FTA

The FTA will review the application and verify all documents. If any information is missing or incorrect, the application may be delayed or rejected.

The processing time may vary depending on the complexity of the case.

6. Receive the Tax Clearance Certificate

Once approved, the Tax Clearance Certificate will be issued and sent via email or can be downloaded from the FTA portal.

You can use this certificate for business closure, ownership transfer, or any official purpose as required.

Documents Required for Tax Clearance Certificate

To apply for a TCC in the UAE, you need to submit the following documents to the FTA:

For Businesses:

- Trade license copy

- Tax Registration Number (TRN) Certificate

- VAT and corporate tax return filings

- Tax payment receipts

- No outstanding dues confirmation

- Company liquidation documents (If applicable)

- Bank statements, if needed

For Individuals:

- Emirates ID copy

- Passport copy

- Tax payment receipts

- No outstanding tax dues statement

Having all the necessary documents prepared in advance ensures a smooth and hassle-free process when applying for a Tax Clearance Certificate in the UAE.

Fees for Tax Clearance Certificate in UAE

The company Tax Clearance Certificate (TCC) application in the UAE requires a submission fee of AED 50. Additional charges may apply depending on the applicant’s tax registration status. It is always advisable to check the latest fees with the Federal Tax Authority (FTA) or tax advisor at Shuraa Tax before applying.

Importance of a Tax Clearance Certificate in the UAE

A Tax Clearance Certificate is an essential document that proves an individual or business has no outstanding tax liabilities with the FTA. Here’s why obtaining a TCC is important in the UAE:

1. Ensures Compliance with Tax Laws

A TCC confirms that all tax obligations, including VAT and corporate tax, have been met, ensuring full compliance with UAE tax regulations.

2. Required for Business Closure or Liquidation

If a company plans to shut down, a TCC is mandatory to prove that all pending taxes have been cleared before finalizing the business closure.

3. Avoids Penalties and Legal Issues

Failing to settle outstanding taxes before applying for a TCC can lead to fines, penalties, and delays in legal processes related to your business or personal financial matters.

4. Smooth Business Ownership Transfers

When selling or transferring business ownership, a TCC is often required to confirm that the company has no pending tax liabilities.

5. Essential for Visa and Residency Applications

In some cases, individuals may need a TCC for visa or residency renewal, especially if they have been involved in business activities in the UAE.

6. Enhances Business Credibility

For businesses, having a TCC demonstrates financial transparency and tax compliance, which helps in building trust with partners, investors, and authorities.

How Shuraa Tax Can Help?

Getting a Tax Clearance Certificate in the UAE is essential to confirm that you have no pending tax dues. Whether you need it for closing a business, transferring ownership, or any other official reason, it’s essential to ensure all tax payments are cleared. The process can sometimes be tricky, so getting help from tax experts can make things easier.

Shuraa Tax is here to assist you with your TCC application, making sure your documents are correct, and you meet all tax requirements. We also offer VAT registration services, corporate tax registration, and other tax services in the UAE. Contact Shuraa Tax today for a hassle-free tax clearance process.