The VAT number in UAE plays a key role in helping businesses operate legally within the country’s tax system. Once a company registers for VAT, it is issued a VAT number, which must be included on invoices and official documents.

This number helps track tax payments and makes it easier for businesses to claim VAT refunds when needed. Whether setting up a new business or managing an existing one, knowing how the VAT number works is essential to staying compliant with UAE tax laws.

In this blog, we will tell you more about the VAT number in the UAE; continue to read more about it!

What is a VAT number in UAE?

A VAT number in UAE, often called a Tax Registration Number (TRN), is a unique 15-digit code assigned to businesses registered under VAT. It helps identify the business and track its VAT obligations. The breakdown of the VAT number is as follows:

- The first digit is the country code, “9,” representing the UAE.

- The next two digits specify the type of organisation: “01” for corporations and “02” for sole proprietors.

- The following three digits represent the business or individual’s Tax Registration Number.

- The next six digits indicate the registration date of the business for VAT purposes.

- The final digit is a check digit, calculated using a specific formula to ensure the number’s validity.

This structure ensures that each VAT number is unique and accurately reflects the registration details of the business or individual.

Why is VAT number important in UAE?

A VAT number is important in the UAE as it helps to conduct business legally.

Without it:

- You cannot charge VAT to customers

- You risk penalties for non-compliance

- Your business reputation may suffer

Getting a VAT number lets you legally charge VAT, claim VAT refunds, and avoid significant fines. This number also boosts customer confidence in your business operations.

Benefits of VAT number in UAE

The benefits of having a VAT number in the UAE include:

Legal Compliance

A VAT number ensures your business complies with UAE tax laws. It helps to avoid penalties or legal issues.

Tax Collection and Reporting

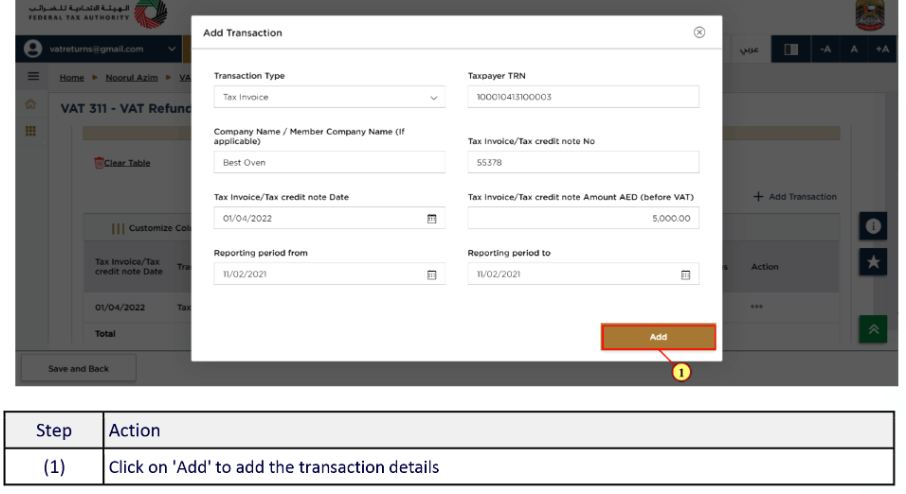

It allows businesses to collect customer VAT and report it to the Federal Tax Authority (FTA) as required.

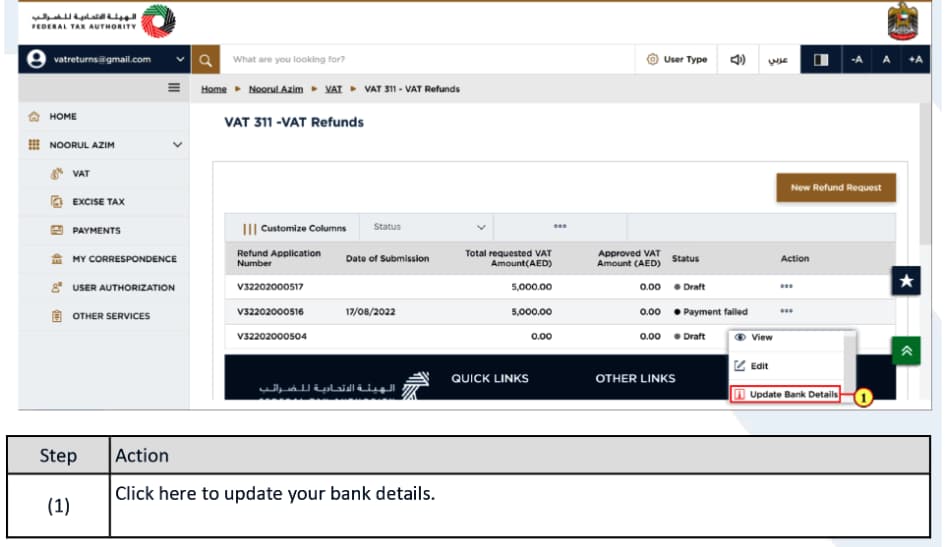

VAT Refunds

Registered businesses can claim refunds on VAT for business expenses. It reduces their overall tax liability.

Improved Business Credibility

Having a VAT number increases the credibility and professionalism of your business, especially when dealing with clients and suppliers.

Eligibility for Government Contracts

Many government contracts require businesses to be VAT-registered. It helps to make a VAT number essential for bidding on such projects.

International Trade Facilitation

A VAT-registered business can conduct international trade more smoothly, as many global suppliers and partners prefer or require VAT-registered entities.

VAT Registration Requirements in UAE

To register for VAT in the UAE, you need:

- Tax Identification Number: Obtain this with the certificate of incorporation from the Trade Register.

- Business License: A copy of the trade or commercial license.

- Passport Copies: For the owner and shareholders.

- Memorandum and Articles of Association

- Company Representative Details: Contact information and proof of the registered UAE address.

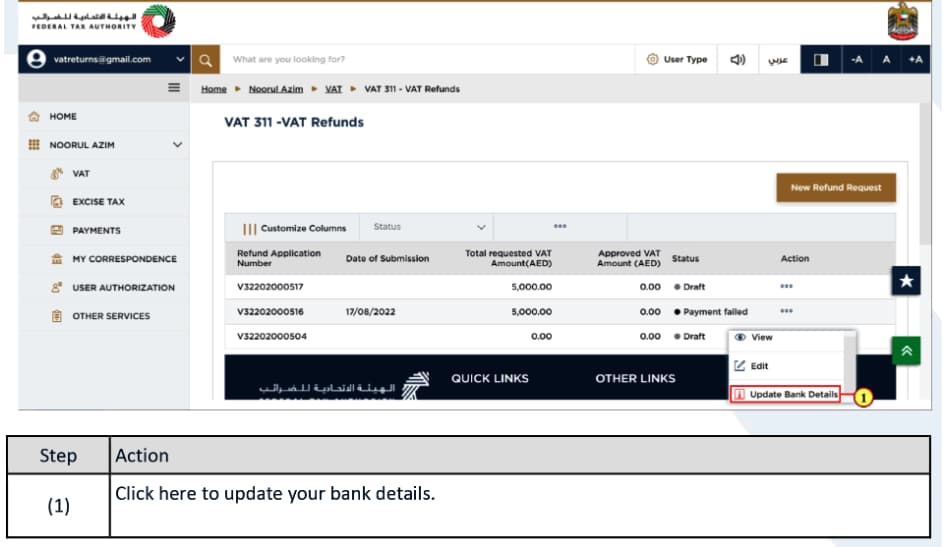

- Bank Account Information: Including IBAN.

- Income Statement: For the last 12 months, if available.

- Revenue Estimates: Expected revenue, turnover, and expenses for the next 30 days.

- Import-Export Information: If applicable.

- Customs Code: Including a copy of the Dubai Custom Code Certificate, if available.

- GCC Trade Information: Details of trade activities in Gulf Cooperation Council countries.

- Business History: If available, describe the company’s experience over the past five years.

- Tax Group Details: If the company is part of a tax group.

- Identification Papers: For natural persons, including visas.

These documents ensure compliance and facilitate the VAT registration process.

Other VAT Requirements

VAT registration is mandatory for businesses with annual incomes exceeding AED 375,000. Companies earning below AED 187,500 may opt for voluntary registration.

The main benefit of VAT registration is the ability to claim refunds on VAT paid. VAT returns must be filed electronically either monthly or quarterly, depending on the income level:

- Monthly: For companies with annual income over AED 150 million.

- Quarterly: For companies with annual income below AED 150 million.

Non-resident companies or individuals involved in activities in the UAE must also register for VAT.

All VAT invoices must be retained for five years. For assistance with VAT registration, local companies can consult our accountants in Dubai.

Steps to get a VAT Registration Number in the UAE

To obtain a VAT registration number in the UAE, follow these steps:

Determine VAT Registration Eligibility

Check if your business meets the VAT registration threshold. Businesses with annual taxable supplies over AED 375,000 are required to register for VAT. Voluntary registration is also available for businesses with taxable supplies over AED 187,500.

Prepare Required Documents

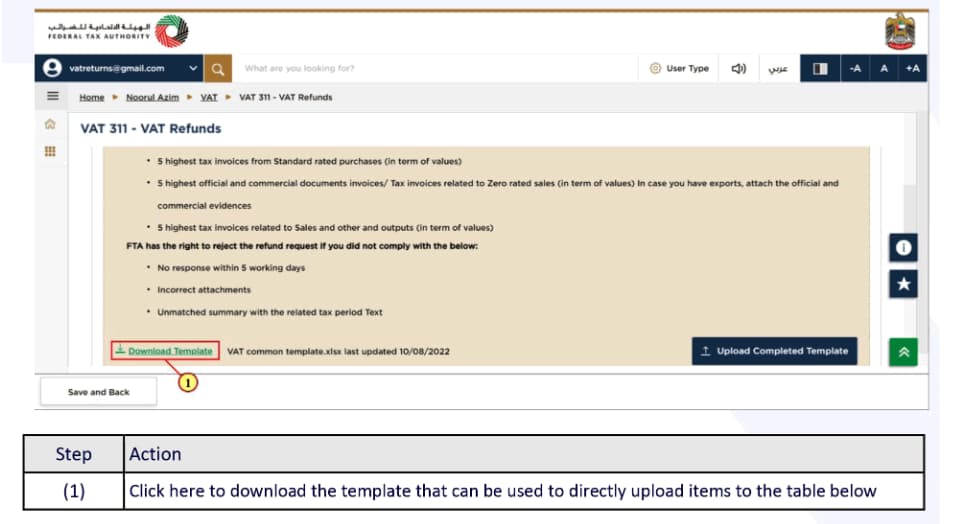

Gather all necessary documents, such as your trade license, passport copies, financial statements, and other documents specified by the Federal Tax Authority (FTA).

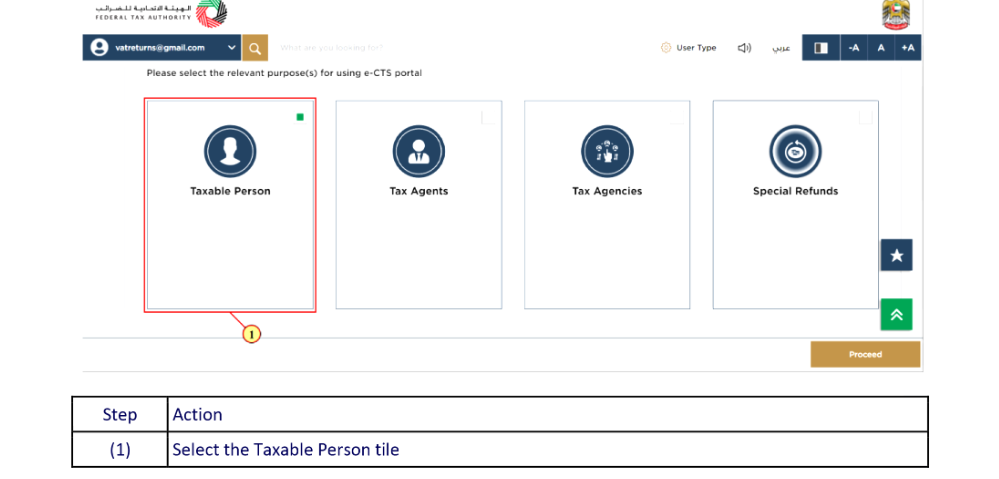

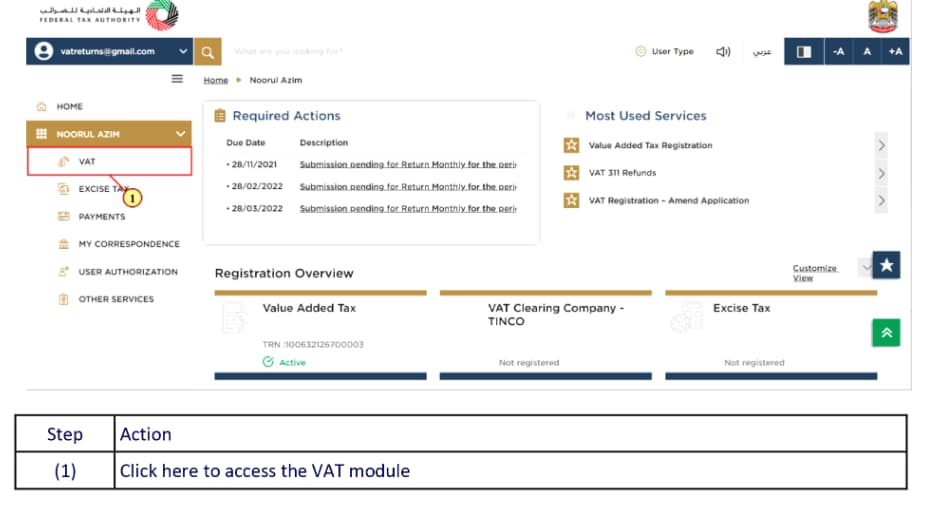

Register Online

Access the FTA online portal and complete the VAT registration process by providing the required details.

Pay Registration Fee

A non-refundable fee applies for VAT registration, which must be paid during application.

Once registered, your business will be issued a VAT registration number, allowing you to charge and report VAT legally.

VAT Exemptions in the UAE

Certain goods and services in the UAE are subject to a 0% VAT rate, which means they are exempt from VAT. These include:

- Exports: Goods and services sold outside the UAE.

- International Transportation: Services related to transporting goods and passengers internationally.

- Aircraft and Sea Transport: Services for operating and maintaining aircraft and ships.

- Investments in Precious Materials: Transactions involving gold, silver, and platinum.

- Residential Properties: The sale and lease of residential real estate.

- Education Services: Educational services provided by accredited institutions.

- Healthcare Services: Medical services provided by licensed healthcare providers.

These exemptions support key sectors and reduce the tax burden on essential services.

Importance of Your VAT Number and How Shuraa Tax Can Help

The VAT number in the UAE is crucial for businesses to operate legally within the country’s tax framework. This unique 15-digit code ensures compliance with UAE VAT laws, facilitates accurate tax reporting, and enables companies to claim VAT refunds.

Understanding and properly managing your VAT number is essential for staying compliant and benefiting from VAT-related advantages.

Whether setting up a new business or managing an existing one, going through the VAT requirements can be complex. Shuraa Tax is here to assist you through every step of the VAT registration process.

Shuraa Tax helps you meet all requirements and optimise your tax management. For more information and personalised support, Get in touch today at +971508912062. You can also drop us an email at info@shuraatax.com.

Frequently Asked Questions

Q1. Who issues the VAT registration number in UAE?

After verifying your application, the Federal Tax Authority (FTA) issues the VAT registration number.

Q2. How many digits make up the VAT registration number?

The VAT registration number is a unique 15-digit identifier.

Q3. What is the validity period of the VAT registration number?

The VAT number remains valid indefinitely if the business maintains its registration status.

Q4. Is mentioning the VAT number in VAT returns mandatory?

Yes, mentioning the VAT number in all VAT returns is mandatory for identification purposes.

Q5. What Happens if You Don’t Have a VAT Number in the UAE?

Businesses without a VAT number may face penalties, fines, and legal action by the FTA.

Q6. What is the purpose of a VAT number in UAE?

The VAT number is used for tax invoicing, VAT returns, and payments, ensuring compliance with VAT regulations. It helps the FTA track VAT collected and verify tax returns.

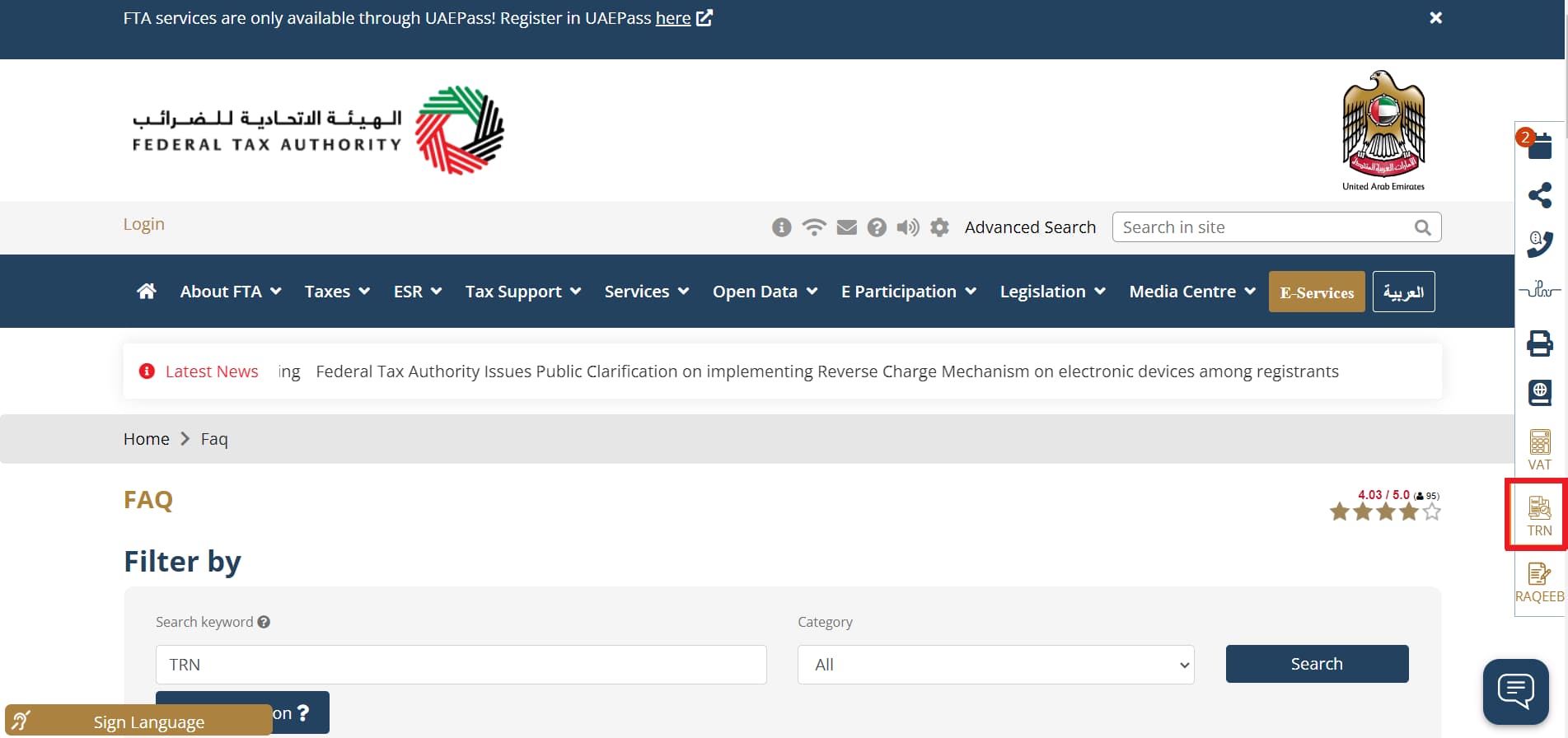

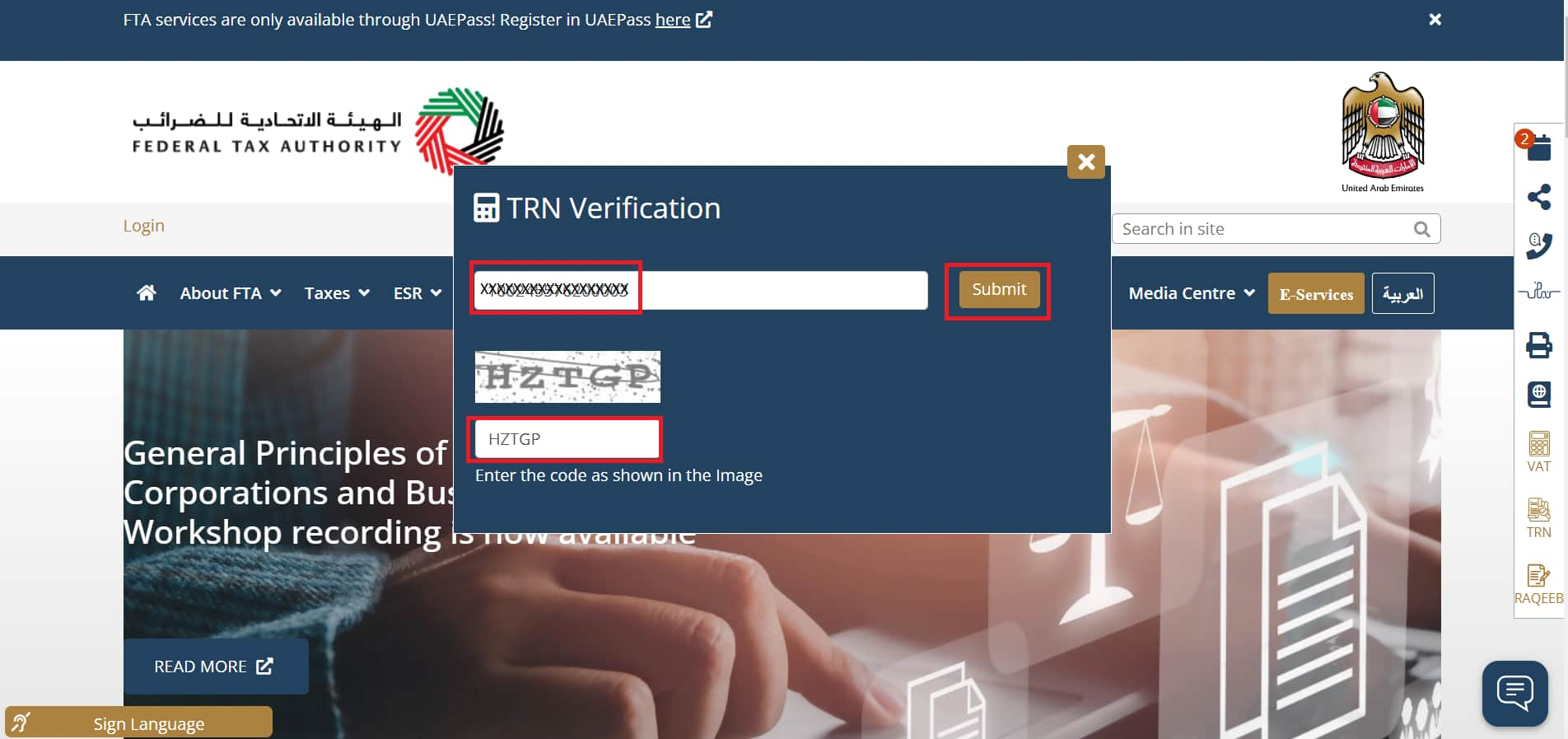

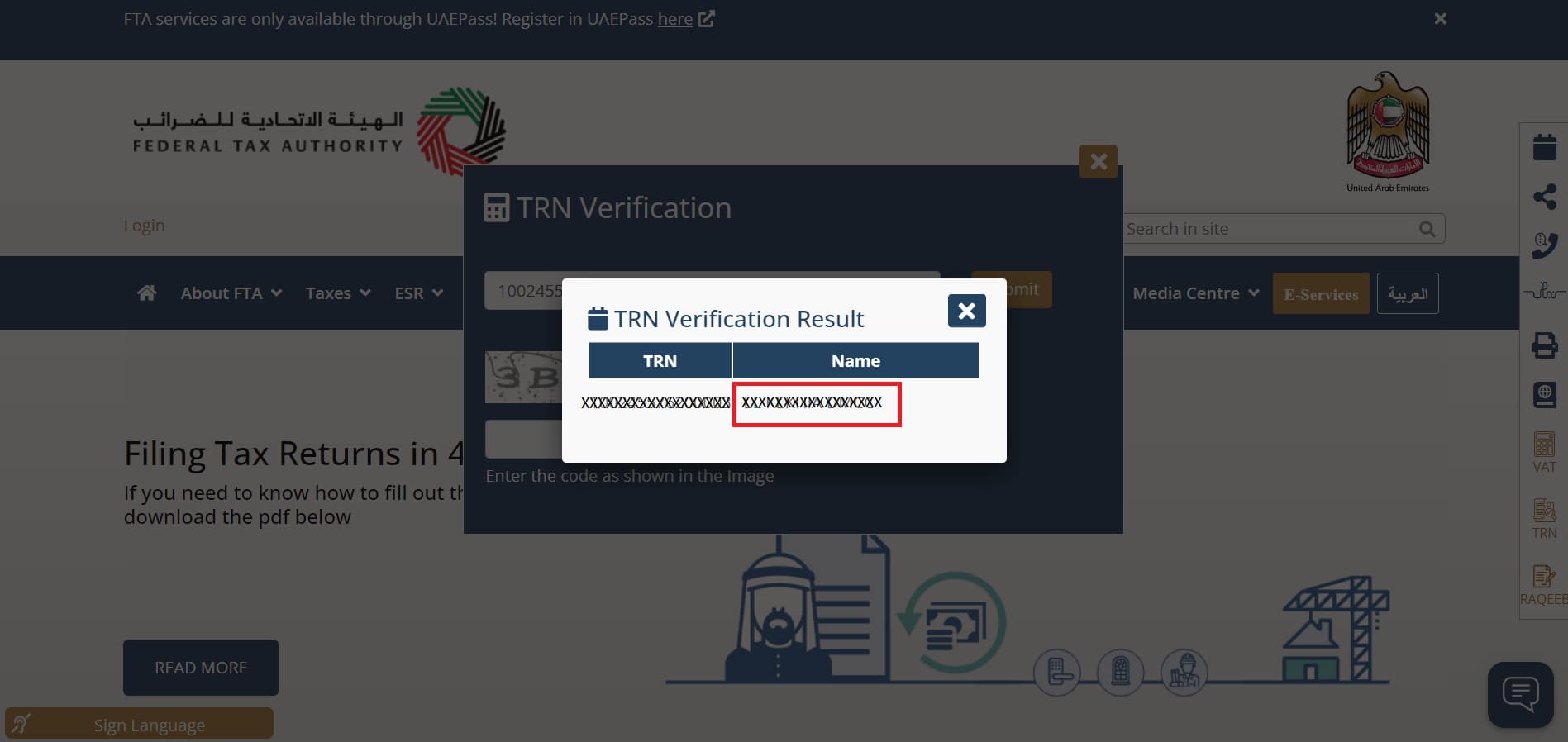

Q7. Can You Check a VAT Number in the UAE?

Yes, you can check a VAT number in the UAE through the Federal Tax Authority (FTA) website.

Q8. Who needs a VAT number?

- Businesses with taxable supplies exceed the registration threshold.

- Entities engaged in VAT-registered activities (goods or services).

- Companies wanting to reclaim VAT on expenses.

- Importers and exporters of goods.

Q9. How to Get a VAT Number in the UAE?

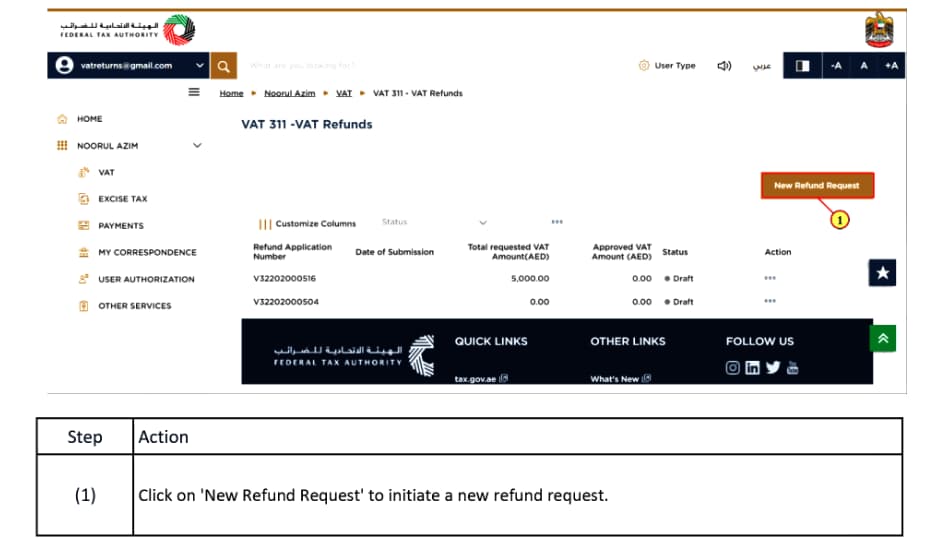

- Register on the FTA Portal: Create an account on the Federal Tax Authority website.

- Fill in Details: Enter your business name, trade license, and contact information.

- Submit Application: Complete and submit your application.

- Receive VAT Number: The FTA will issue your VAT number upon approval.

These steps will ensure your business complies with UAE tax regulations.

Q10. Can Freelancers Get a VAT Number?

Yes, freelancers can get a VAT number in the UAE. If your freelance business meets the VAT registration threshold and engages in taxable activities, you can apply for a VAT number.

This allows you to charge VAT on your services, claim VAT refunds, and comply with UAE tax regulations.