The Federal Tax Authority (FTA) gathers and manages taxes. It furnishes comprehensive laws, guidance, and explanations to aid commercial entities. The UAE government presented Tax (VAT) on January 1st, 2018. VAT consultants in Abu Dhabi constitutes an indirect tax imposed on the utilisation of products and services, knowingly influencing business operations. The keen risk, quantity, and difficulty of transactions must be better for taxpayers to fulfil tax compliance obligations.

Since the inception of VAT in the UAE, Shuraa Tax has remained committed to delivering committed professional assistance to taxpayers. Our services include supporting businesses in their transactions, guaranteeing correct tax procedures, and undertaking conflicts. In this blog post, we aim to point you towards the leading VAT consultants in Abu Dhabi for 2026.

How do Abu Dhabi’s VAT consultants assist businesses?

VAT consultants are crucial partners for businesses directing the involved landscape of Value Added Tax regulations. These professionals offer services to safeguard compliance, provide expert advice, and optimise VAT-related processes. From assisting with initial registration and filing VAT returns to providing direction on complex transactions and pricing strategies, VAT consultants play a key role in helping businesses understand and manage their VAT obligations effectively. They provide custom-made solutions to ease risks, implement internal controls, and develop VAT strategies that align with the unique needs of each business.

Moreover, VAT consultants keep well-informed of changes in VAT laws and regulations, guaranteeing that companies stay informed and adapt to growing requirements seamlessly. With their skill, businesses can confidently steer the difficulties of VAT, minimising tax liabilities and maximising compliance.

Abu Dhabi’s Shuraa VAT Consultant Services

VAT consulting services in Abu Dhabi boast expertise and exercise in the details of value-added tax in the region. The imposition of VAT on goods and services in Abu Dhabi falls under the jurisdiction of the Federal Tax Authority. In Abu Dhabi, businesses must register for VAT and submit VAT returns once their annual sales surpass AED 375,000. VAT consultants in Abu Dhabi offer a range of services, including:

- VAT return filing

- VAT audits

- VAT consultations

- Representation services

Following to VAT regulations necessitates businesses to file monthly returns and furnish an audit report. VAT consultants in Dubai offer complete VAT legislation services.

Top VAT Consultants in Abu Dhabi

The foremost VAT consultants in Abu Dhabi include:

Shuraa Tax

Shuraa Tax is broadly recognised as a leading authority among VAT Consultant Services in Abu Dhabi, setting the industry’s standard for quality and reliability. With an established track record of excellence, they have established themselves as trusted advisors to numerous businesses across various sectors.

What sets Shuraa Tax apart is its thorough understanding of the details of VAT law and its proactive approach towards helping businesses steer the difficulties of agreement. By staying well-informed of the latest developments and updates in VAT regulations, they guarantee that their clients are always well-informed and prepared to meet their legal obligations.

Shuraa Tax is more than just a service provider; it is a trusted partner committed to empowering businesses to flourish in an ever-evolving regulatory landscape. With their firm dedication to excellence and client satisfaction, it’s no wonder they are consistently ranked among the top VAT consultants in Abu Dhabi.

Deloitte & Touche

Deloitte’s VAT consultants stand out for their deep understanding of the complex tones of VAT law. They possess a complete grasp of the legal framework and an acute awareness of the broader industry dynamics. By combining legal expertise with industry insight, they are uniquely positioned to offer custom-made solutions that address the specific needs and challenges businesses in Abu Dhabi face. Moreover, Deloitte’s VAT consultants recognise the growing importance of technology in determining the landscape of tax compliance.

They leverage cutting-edge tools and methodologies to streamline processes, improve accuracy, and guarantee compliance with evolving regulatory requirements. This forward-thinking approach enables them to stay ahead of the curve and provide clients with innovative solutions that drive efficiency and effectiveness.

In addition to their technical proficiency, Deloitte’s VAT consultants are known for their competence and professionalism. With a proven track record of bringing results, they see confidence in their clients and inspire trust through their dedication to excellence. As trusted advisors, they go above and beyond to provide personalised service and strategic leadership that helps businesses quickly steer the complexities of VAT compliance.

KPMG

KPMG, well-known as one of the top VAT consultants in Abu Dhabi, differentiates itself through its proactive leadership and meticulous execution in ensuring compliance with VAT regulations. Their approach goes beyond mere advisory services; they take the reins in supervisory businesses through the complexities of VAT compliance, offering comprehensive support at every stage of the process.

By leveraging their extensive expertise and resources, KPMG assists businesses in steering the complicated web of VAT laws and regulations, thereby minimising the risk of legal issues arising from non-compliance. Their thorough understanding of the legal landscape allows them to identify and proactively address potential pitfalls, safeguarding businesses against costly penalties and disputes.

In essence, KPMG’s role as a top VAT consultant in Abu Dhabi extends beyond mere compliance; they serve as strategic partners dedicated to supporting businesses in achieving their objectives while minimising risks and maximising opportunities in VAT. Their proactive approach and solid commitment to excellence make them a trusted ally for businesses seeking to direct the intricate landscape of VAT regulations with confidence and peace of mind.

PricewaterhouseCoopers

PricewaterhouseCoopers (PwC) stands at the forefront of driving change in tax laws, leveraging its significant influence to engage in discussions with tax officials and governments actively. Their proactive approach towards shaping tax legislation reflects their deep commitment to serving as thought leaders and catalysts for positive change in the tax landscape.

PwC’s expertise in tax matters extends far beyond mere compliance; they possess an in-depth understanding of the intricacies of tax laws and regulations, allowing them to offer strategic insights and direction to their clients. By staying well-informed of the latest developments and trends in tax policy, PwC can anticipate changes and provide timely advice to help businesses adapt and thrive in an ever-developing regulatory environment.

In essence, PwC’s proactive approach, coupled with its unmatched expertise and influence in the field of tax, makes it a trusted partner for businesses seeking to direct the intricacies of VAT compliance and taxation in Abu Dhabi. By easing up their insights and resources, PwC helps companies stay ahead of the curve and achieve their strategic objectives in a rapidly changing regulatory landscape.

Ernst & Young

Ernst & Young (EY), recognised as one of the foremost VAT consultants in Abu Dhabi, distinguishes itself through its innovative approach to VAT compliance. EY goes beyond traditional advisory services by leveraging cutting-edge practices and technologies to help clients transform legal compliance into a strategic advantage.

EY’s innovative practices are designed to ensure adherence to VAT regulations and reveal hidden value within businesses. By adopting a forward-thinking mindset, EY helps clients identify opportunities to optimise their VAT strategies and improve overall business performance.

EY’s commitment to innovation and client-centric approach sets them apart as a trusted advisor in VAT consultancy. By harnessing the power of innovative practices, EY enables clients to meet their legal obligations and seize opportunities for growth and innovation in an ever-changing business landscape.

Reasons to Engage VAT Consultant Services in Abu Dhabi:

- Employing top-tier methodologies for precise VAT calculations.

- Making bespoke consulting solutions tailored to clients’ specific requirements.

- Representative professionalism and proficiency in directing VAT regulations.

- Conducting thorough reviews to assess the effects of VAT implementation on businesses.

- Scrutinising business operations to ensure compliance with VAT regulations in Dubai, UAE.

- Provided support during VAT audits and represented clients in dealings with VAT officials.

- Supervising clients through VAT processes to streamline operations and ensure compliance with ease.

Services Offered by Shuraa Tax VAT Consultants

Below is the list of services that Shuraa Tax offers:

1. VAT Advisory Services

Providing tailored advisory services to address industry-specific needs, offering guidance on transactions and their tax implications.

2. VAT Return Filing Service

Supporting UAE businesses in completing and filing VAT Return Form 201, including direction on reconciliation input and output VAT and computing tax liability. Leading reviews of previously submitted VAT returns to identify and rectify errors or omissions.

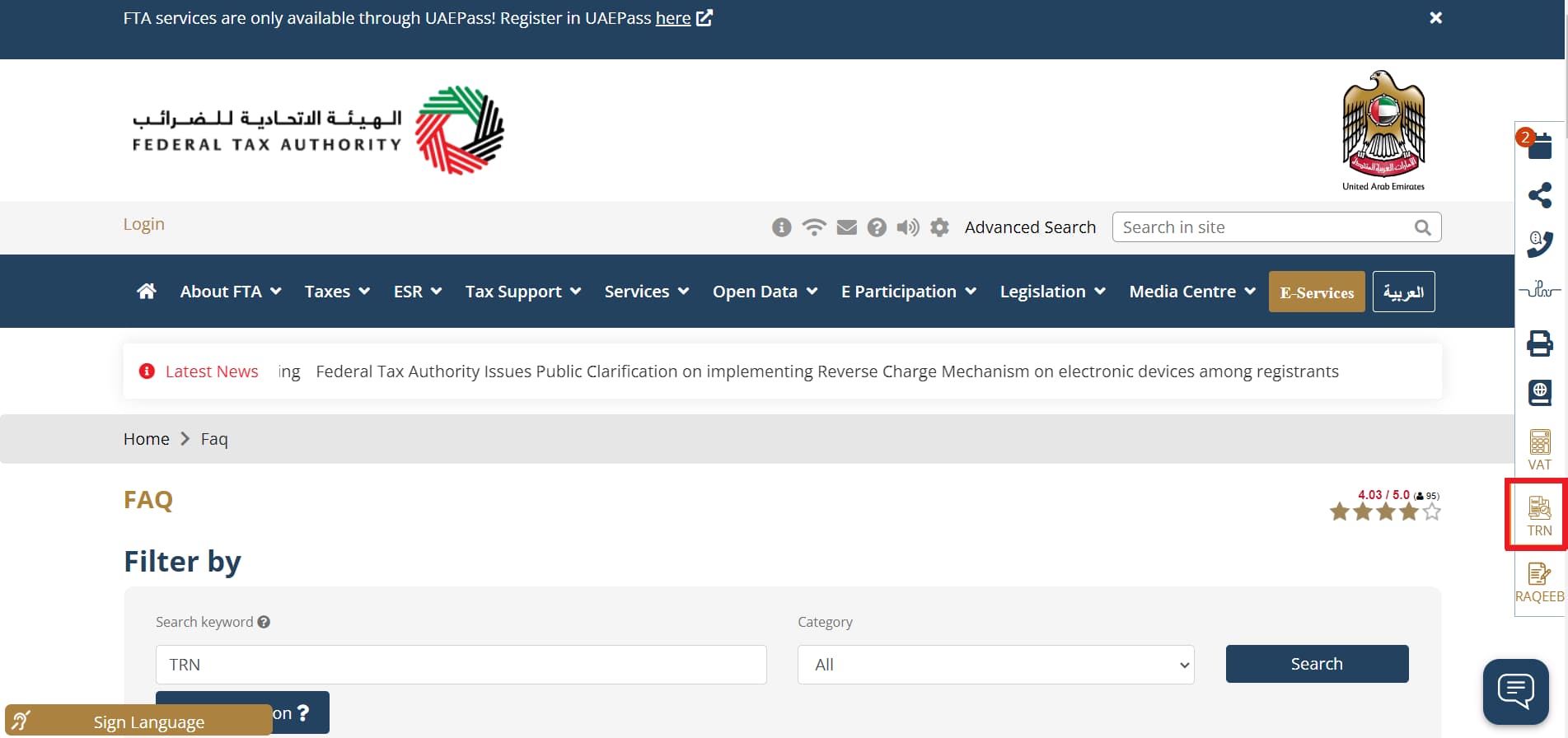

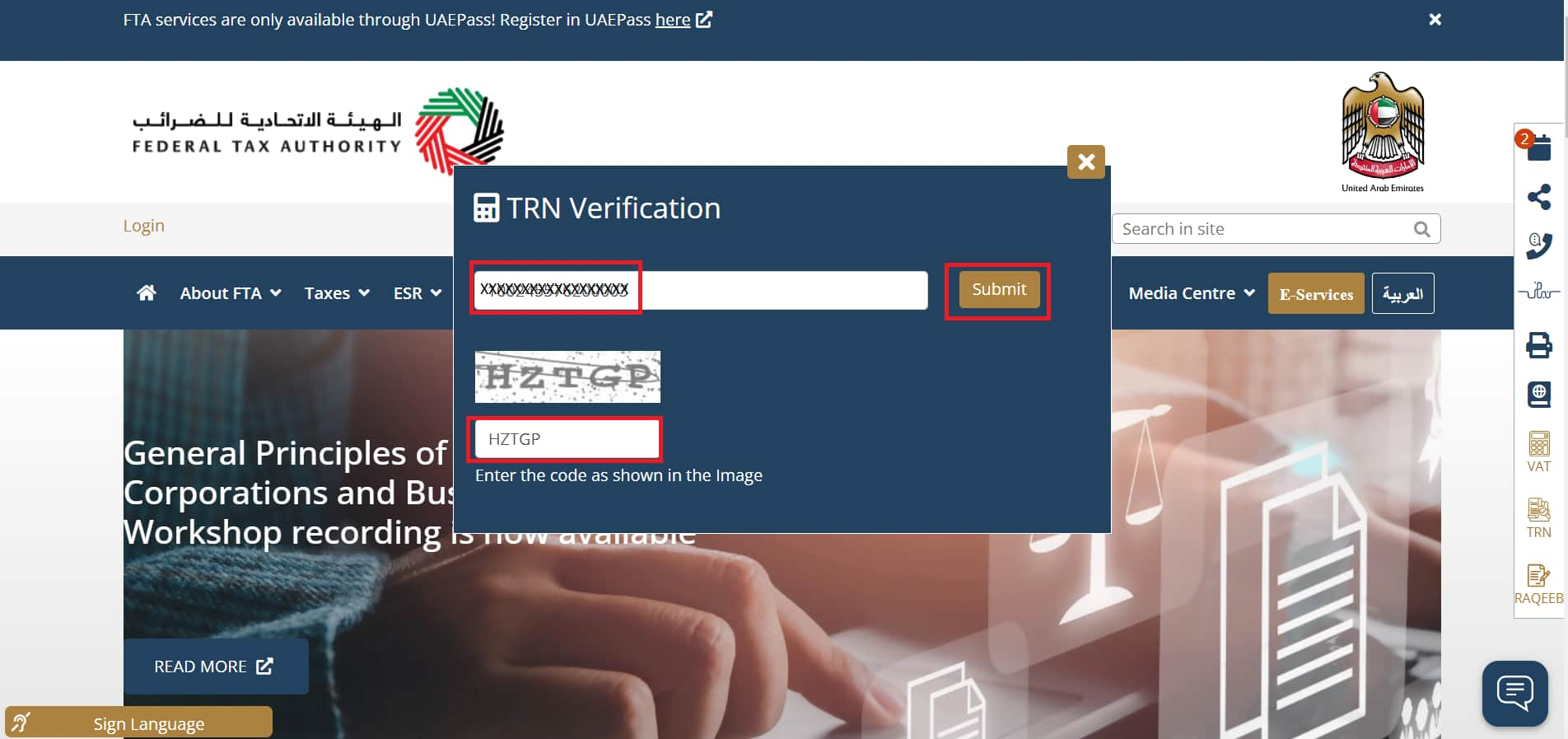

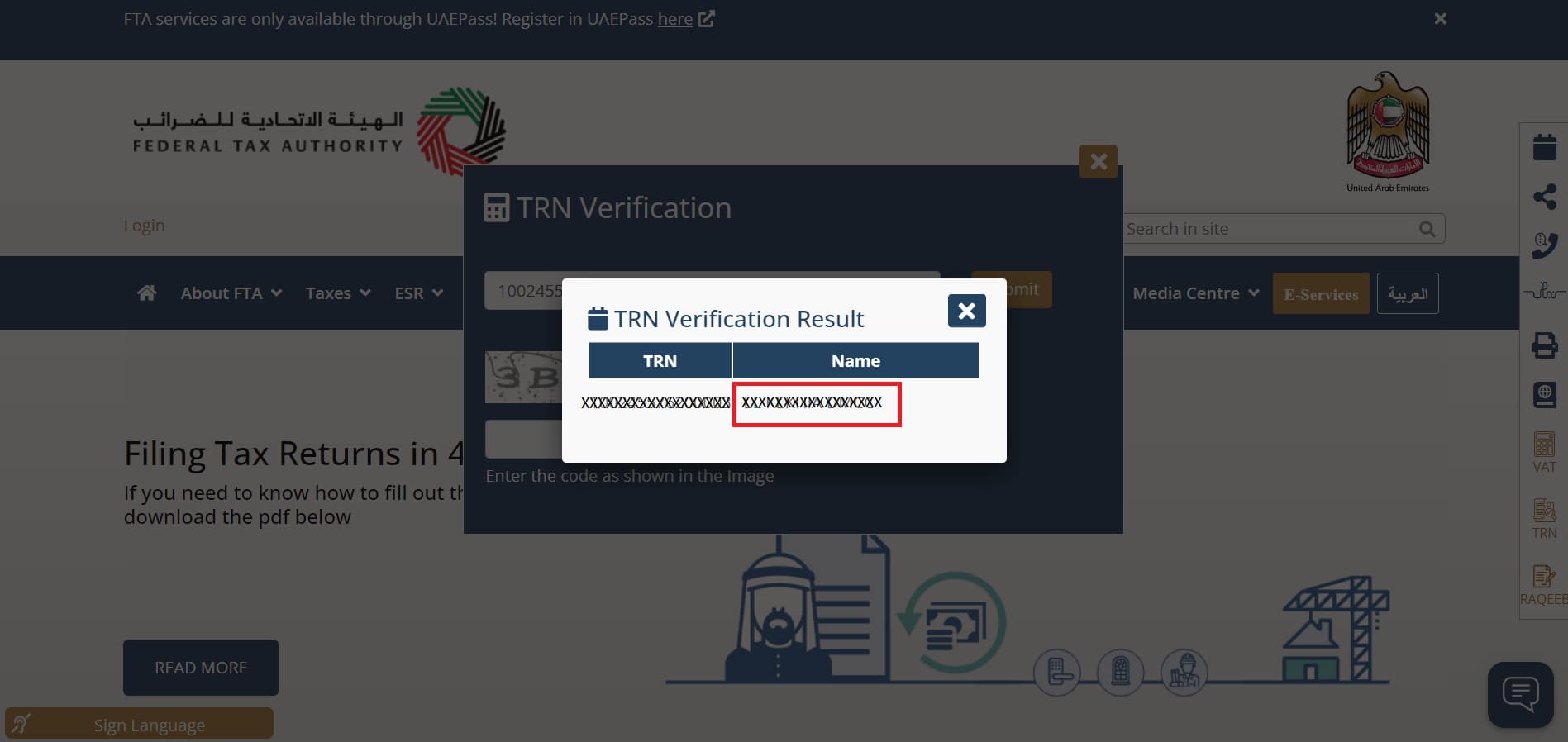

3. VAT Registration

We assist businesses in the VAT registration process, ensure compliance with regulations, and facilitate a smooth transition into the tax system.

4. VAT Deregistration

Supporting businesses in applying for VAT deregistration within the required timeframe to avoid potential penalties. Ensuring a seamless process for cancelling tax registration numbers.

5. VAT Training

Presenting customised training sessions for individuals and corporate entities on VAT laws and regulations. Leveraging the expertise of our professionals to provide complete training custom-made to specific business needs.

6. VAT Transactions Advisory

Providing guidance on industry-specific transactions, particularly for businesses with complex operations, products, or branches. Keeping abreast of recent developments to offer informed advice on VAT matters.

Concluding Thoughts with Shuraa Tax

This overview of leading VAT consultants has assisted you in determining the ideal VAT consultancy for your needs. For further insights into VAT consultancy or any tax and accounting inquiries, please don’t hesitate to contact us. Reach out today at +971508912062 or via email at info@shuraatax.com. We look forward to assisting you!

Frequently Asked Questions

Q1. What taxes apply to companies in Abu Dhabi?

In Abu Dhabi, Value Added Tax (VAT) applies to most goods and services, while excise tax is levied on specific goods. Individual income tax is not imposed, but oil companies and foreign banks are subject to corporate tax.

Q2. What services do tax consultants offer in Abu Dhabi?

Tax consultants, well-versed in tax laws, act as advisors to clients, aiding in tax planning, compliance, and reporting.

Q3. What factors should be considered when hiring a tax consultant?

When selecting a tax consultant, measuring their expertise in the relevant tax laws, cost-effectiveness, and industry-specific knowledge relevant to the business activities is essential.

Q4. What are the key features of a tax accounting application?

Choosing a tax accounting application hinges on ensuring compliance with applicable tax laws and enhancing efficiency in tax processes.